The Nairobi Securities Exchange (NSE) has become a powerhouse for Kenya’s financial sector, with banks dominating its rankings like never before.

As of August 2025, 8 of the top 10 most valuable companies listed on the NSE are banks, and all 11 listed banks secure spots in the top 20, collectively accounting for 38% of the market’s KSh2.6 trillion valuation.

This massive shift highlights the banking sector’s growing influence, turning the NSE into what some call a “bankers’ playground.”

How did banks achieve this dominance, and what does it mean for investors and Kenya’s economy? Let’s explore the key drivers and implications of this trend.

The Banking Sector’s Grip on the NSE

Kenya’s banking institutions have surged to the forefront of the NSE, reshaping its landscape.

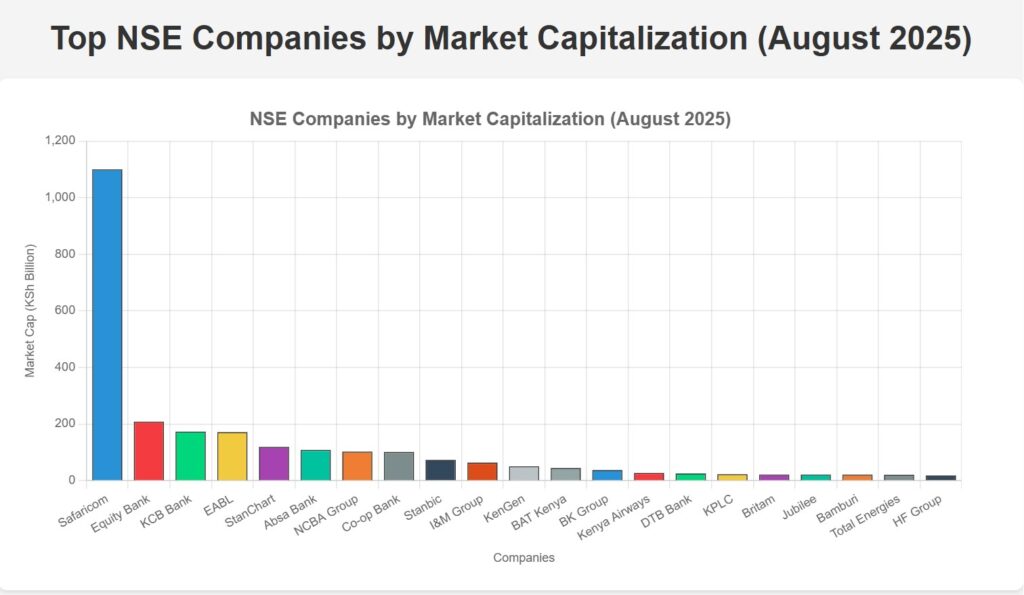

According to recent data, Safaricom leads with a commanding market capitalisation of KSh1.1 trillion, but banks like Equity Bank (KSh208 billion) and KCB Bank (KSh173 billion) follow closely, securing second and third places.

Other financial heavyweights, including Standard Chartered (KSh119 billion), Absa (KSh108 billion), NCBA (KSh102 billion), Co-operative Bank (KSh101 billion), Stanbic (KSh73 billion), and I&M (KSh63 billion), solidify the sector’s dominance in the top 10.

This marks a significant shift from a decade ago when non-financial firms like East African Breweries (EABL) held higher rankings.

The rise of banks is driven by several key factors:

- Robust Financial Performance: Banks have posted consistent profit growth and generous dividends, boosting investor confidence. For instance, KCB and Equity reported full-year net profits of KSh60 billion and KSh46.5 billion, respectively, in 2024, a sharp rise from a decade earlier.

- Digital Innovation: Kenyan banks have embraced mobile banking and fintech solutions, such as Equity’s Equitel and NCBA’s M-Shwari, driving customer growth and operational efficiency. This technological edge has attracted investors betting on future scalability.

- Regional Expansion: Banks like Equity, KCB, and NCBA have expanded into markets like Uganda, Rwanda, and the Democratic Republic of Congo, leveraging low financial inclusion to fuel growth. This regional footprint enhances their market valuations.

- Regulatory Environment: The lifting of interest rate caps in 2019 and supportive Central Bank of Kenya policies have enabled banks to improve lending margins, further strengthening their financial positions.

Top NSE Companies by Market Capitalisation

Here’s a breakdown of the most valuable companies on the NSE as of August 2025, highlighting the banking sector’s dominance:

- Safaricom (KSh1.1 trillion): Kenya’s telecom giant, leading with its M-Pesa platform and 47 million subscribers.

- Equity Bank (KSh208 billion): A financial powerhouse with a focus on inclusion and regional growth.

- KCB Bank(KSh173 billion):East Africa’s largest bank by assets, expanding through acquisitions.

- East African Breweries (EABL) (KSh171 billion): A beverage leader, but outpaced by banks.

- Standard Chartered (StanChart) (KSh119 billion): A global bank with a strong corporate banking focus.

- Absa Bank (KSh108 billion): rebranded from Barclays, excelling in digital transformation.

- NCBA Group (KSh102 billion): A fast-growing bank leveraging M-Shwari and digital platforms.

- Co-operative Bank (KSh101 billion): Known for community-focused banking and MCoop Cash.

- Stanbic Holdings (KSh73 billion): A key player in corporate and wealth management.

- I&M Group (KSh63 billion): Operating across five countries with a diversified portfolio.

Other Notable Companies

The following companies, while not in the top 10, are significant players on the NSE with notable market capitalisations as of August 2025:

- KenGen: KSh50 billion

- BAT Kenya: KSh44 billion

- BK Group: KSh37 billion

- Kenya Airways (KQ): KSh27 billion

- DTB Bank: KSh25 billion

- KPLC: KSh22 billion

- Britam: KSh21 billion

- Jubilee: KSh21 billion

- Bamburi: KSh20.5 billion

- Total Energies: KSh20 billion

- HF Group: KSh17.6 billion

Why Banks Are Winning

Several structural and market-driven factors explain why banks have overtaken traditional heavyweights like EABL and BAT Kenya:

- Asset Strength and Stability: Banks manage large asset bases; KCB’s reached KSh1.4 trillion in 2024, offering investors a sense of security and long-term growth potential.

- Dividend Reliability: Banks like Standard Chartered (KSh45 per share in 2024) and Co-operative Bank consistently pay dividends, appealing to income-focused investors.

- Mergers and Acquisitions: The 2019 merger of NIC and CBA to form NCBA, along with KCB’s acquisition of National Bank, created stronger, more competitive entities with enhanced market value.

- Market Share Growth: Kenyan banks like KCB (13.8% market share) and Equity (12.2%) lead in assets and deposits, reinforcing their dominance.

Implications for Investors and the Economy

The banking sector’s stronghold on the NSE has significant implications:

- Investment Opportunities: With 38% of the NSE’s KSh2.6 trillion market cap tied to banks, investors can tap into stable, high-growth stocks like Equity and KCB. However, diversification is crucial to mitigate risks like regulatory changes or loan defaults.

- Economic Impact: Banks drive financial inclusion, lending, and job creation, positioning Kenya as East Africa’s financial hub. Their regional expansion also boosts cross-border trade and investment.

- Potential Risks: Regulatory shifts, such as tightened microfinance rules, could challenge smaller banks like HF Group. Additionally, over-reliance on banks may expose the NSE to sector-specific risks, such as economic downturns affecting loan repayments.

READ ALSO:NSE Giants: Who Holds the Most Market Cap?

A Bank-Driven NSE

The NSE’s transformation into a bankers’ playground reflects the resilience and innovation of Kenya’s financial sector.

With 8 of the top 10 and all 11 listed banks in the top 20, institutions like Equity, KCB, and NCBA are not just managing wealth; they’re shaping the market.

For investors, this presents a chance to capitalise on strong performers, but careful risk management is essential. As banks continue to innovate and expand, their dominance on the NSE highlights their critical role in driving Kenya’s economic future.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, and digital finance at Africa Digest News.

Leave a Reply