In a market where speed and convenience define winners, Ozow and TymeBank are raising the bar. Their partnership on PayShap Request could set the new standard for South Africa’s digital transactions.

This move aligns with the South African Reserve Bank’s vision for a modern, inclusive digital payments ecosystem and comes at a time when demand for seamless, low-cost transactions is surging.

As South Africans increasingly turn to digital banking solutions, understanding this partnership’s implications is crucial for businesses, merchants, and everyday users.

What is PayShap Request? A Quick Overview

PayShap is South Africa’s real-time payment system, designed to facilitate instant interbank transfers for low-value transactions up to R5,000.

Launched by BankservAfrica, it represents a shift toward faster, more efficient digital payments, reducing reliance on traditional EFTs that can take days to clear.

PayShap Request takes this a step further. It’s an extended service that allows the payee (like a merchant or individual) to initiate a real-time payment request.

Here’s how it works in simple terms:

- Initiation: The payee sends a request using the payer’s bank account details, ShapID (a unique identifier like a cellphone number or email), or cellphone number.

- Notification: The payer receives a push notification in their banking app.

- Approval: The payer approves the transaction, and the payment clears instantly, with funds reflecting in the payee’s account in seconds.

- Use Cases: Ideal for e-commerce, peer-to-peer transfers, and merchant payments, it empowers users to “own the way they pay and get paid.”

Introduced in December 2024, PayShap Request has seen rapid adoption, with participating banks including African Bank, Capitec, Discovery, FNB, Investec, Nedbank, Standard Bank, and now TymeBank leading the charge.

Platforms like Ozow have been at the forefront, integrating it to offer merchants a convenient alternative to card-based or manual payments.

READ ALSO:How One Feature Is Accelerating South Africa’s Shift to Digital Payments

Breaking Down the Ozow and TymeBank Partnership

Ozow, known for its secure instant EFT solutions, became one of the first platforms to launch PayShap Request for merchants in July 2025.

This initial rollout provided valuable insights from live data, paving the way for expansion. The partnership with TymeBank marks a significant milestone by adding TymeBank as Ozow’s second sponsor bank.

TymeBank, which crossed 10 million customers in December 2024, is a digital banking powerhouse committed to affordable, accessible services. As part of this tie-up:

- Enhanced Integration: Merchants using Ozow can now offer PayShap Request at checkout, supported by TymeBank’s infrastructure. This means more online shopping platforms will include it as a payment option.

- Free for TymeBank Users: TymeBank offers PayShap payments at no cost, making it an attractive, low-friction choice for real-time transfers.

- Broader Reach: The collaboration strengthens Ozow’s role as a single integration partner for merchants, improving resilience and access across the payments ecosystem.

Rachel Cowan, interim CEO of Ozow, highlighted the partnership’s focus on financial inclusion and innovation, noting that early data from the July launch has informed this expansion.

Similarly, TymeBank’s involvement signals its push for modern payment solutions that benefit both consumers and businesses.

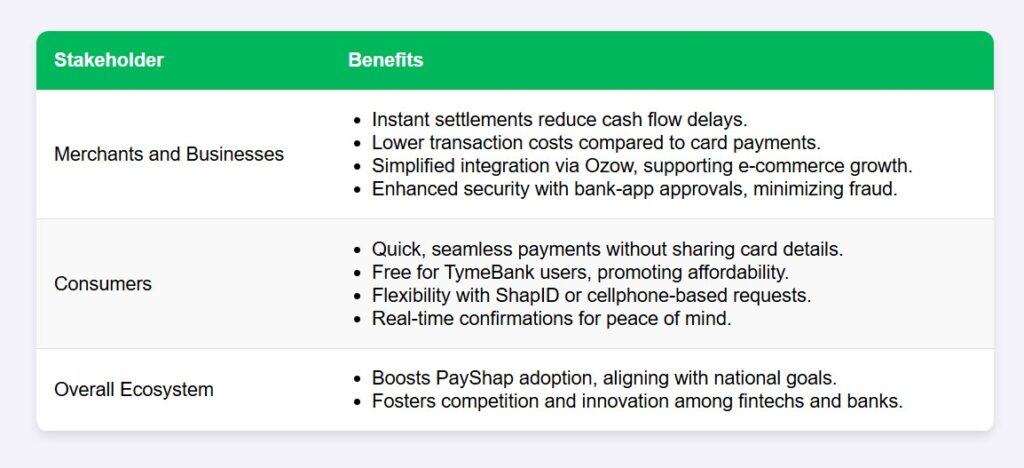

Key Benefits for Businesses and Consumers

This Ozow-TymeBank partnership isn’t just about technology; it’s about real-world advantages. Here’s a breakdown:

- Faster transactions with instant settlement

- Lower transaction costs compared to cards or EFTs

- Increased trust and convenience for merchants and consumers alike

By making payments faster and cheaper, this expansion could accelerate South Africa’s shift to a cashless economy, especially in underserved areas.

Driving Financial Inclusion in South Africa

One of the partnership’s core goals is promoting financial inclusion. With TymeBank’s customer base largely comprising previously unbanked or underbanked individuals, offering free PayShap services lowers barriers to entry.

PayShap Request empowers small business owners, freelancers, and informal traders to receive payments instantly, without high fees or complex setups.

BankservAfrica’s Israel Skosana emphasised the collaborative spirit behind PayShap’s growth, noting partnerships with fintechs like Ozow are key to bringing real-time payments to more South Africans.

As of now, with 12 participating banks and growing fintech integrations, the ecosystem is set for widespread adoption.If you’re ready to explore PayShap Request, check out Ozow or TymeBank’s apps today.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, and digital finance at Africa Digest News.

Leave a Reply