Africa’s telecom giant MTN Group has kicked off 2025 with a powerful statement: Nigeria and Ghana are not just key markets; they’re performance powerhouses.

In its Q1 results, MTN reported a 19.8% surge in service revenue, with Nigeria and Ghana alone accounting for over 41% of the Group’s income.

These numbers aren’t just impressive; they’re strategic signals that MTN’s regional leadership is now the engine behind its evolving financial future.

MTN’s Q1 2025: Revenue Rising, Momentum Building

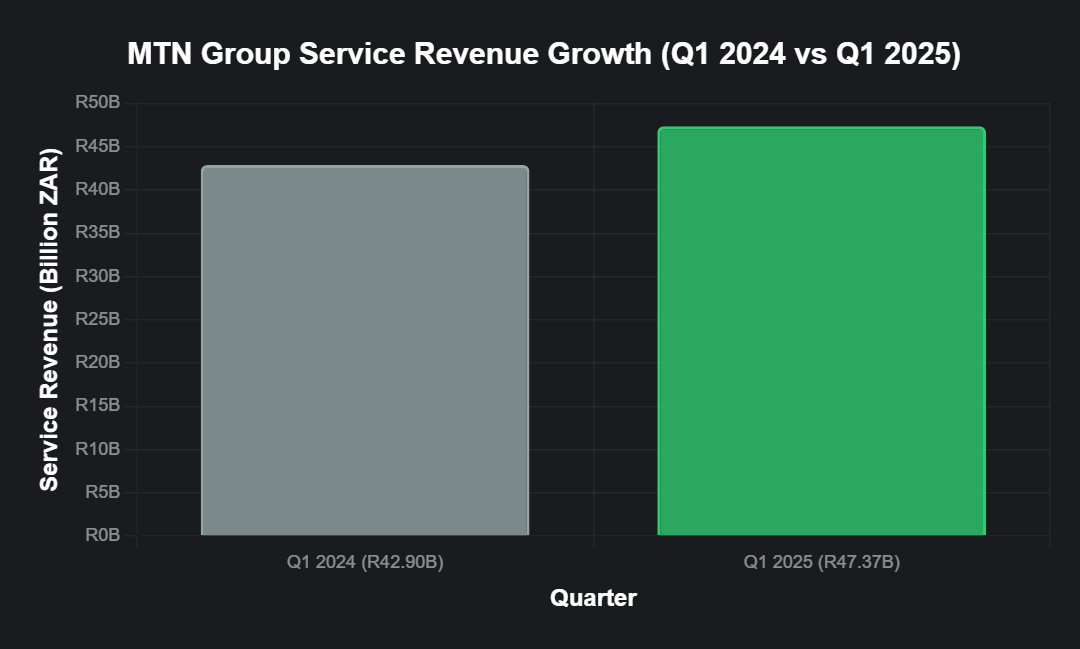

MTN Group reported R47.37 billion ($2.6 billion) in service revenue for the quarter ended March 31, up from R42.90 billion.

Even more impressive is the constant currency growth of 19.8%, a testament to operational efficiency and regional resilience.

Key highlights:

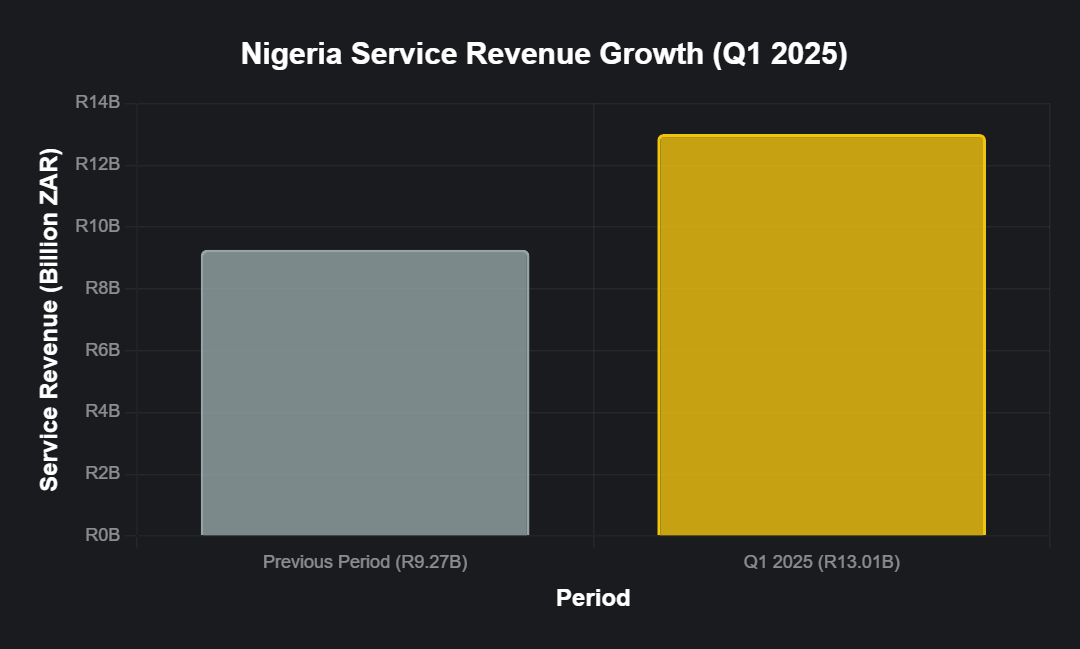

- Nigeria revenue up 40.4% to R13.01 billion ($715.55 million).

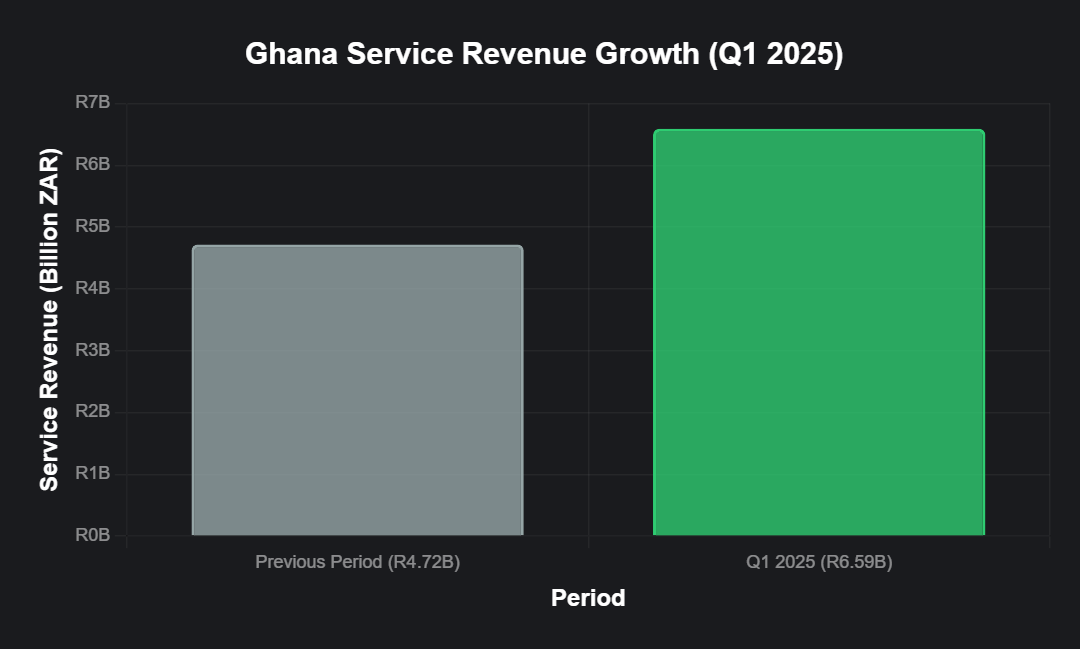

2.Ghana revenue up 39.5% to R6.59 billion ($362.45 million).

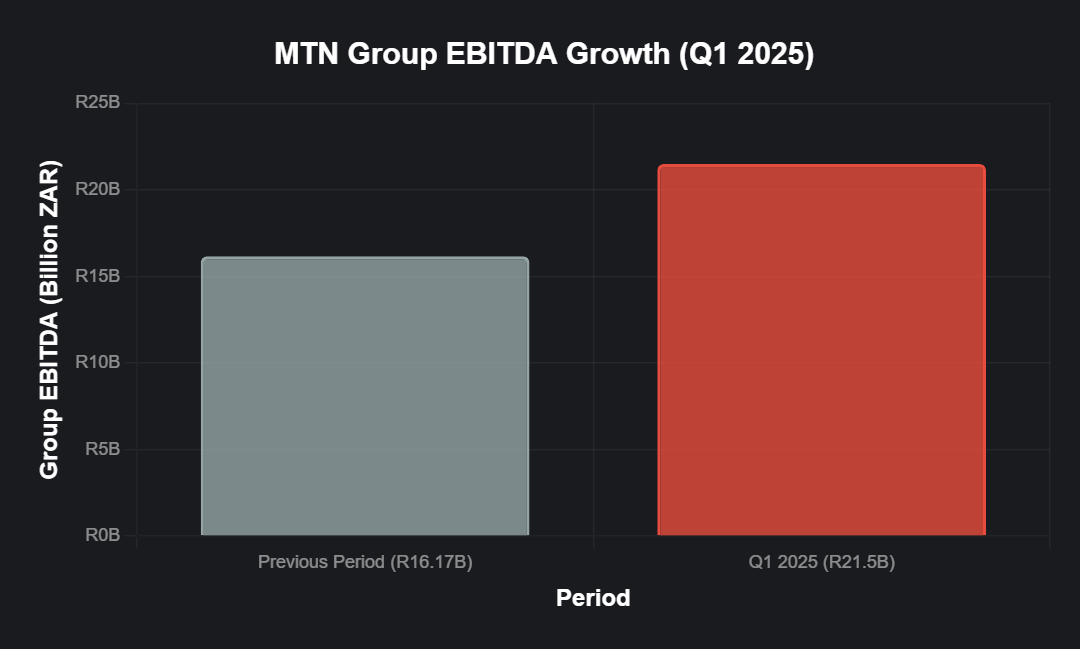

3.Group EBITDA increased 33% to R21.5 billion($1.1825 billion).

4.EBITDA margin rose to 44.1%, underscoring cost discipline and revenue quality.

Combined, Nigeria and Ghana now contribute 41.5% of total service revenue, a major leap that reflects strategic market prioritisation.

READ ALSO:

Safaricom Kenya Just Hit KShs 364 Billion in Revenue

Why Nigeria and Ghana Are Leading the Pack

Nigeria: Africa’s Telecom Titan

With over 80 million subscribers and smartphone penetration hitting 60.7%, MTN Nigeria continues to be the group’s growth backbone. A 40.4% revenue surge highlights how mobile data, fintech, and enterprise services are resonating with Nigeria’s fast-digitising economy.

Key Nigeria trends:

- Average data usage grew 29.5%.

- 4G and 5G rollout accelerated

- Price adjustments set to boost Q2 revenue further

Ghana: A Fintech and MoMo Hotspot

MTN Ghana isn’t just contributing 14% of group revenue; it’s redefining what’s possible in mobile money. Ghana is a MoMo leader, and MTN is capitalising on digital payments, insurance, lending, and remittance opportunities.

Recent wins in Ghana:

- MoMo adoption surged.

- Lending volumes grew significantly.

- Regulatory alignment on fintech separation is underway.

Fintech Fuels the Future: MoMo’s Massive Growth

MTN’s fintech division is no longer a side hustle; it’s a financial platform in its own right. Revenue in this unit rose 25.2%, while total transaction value soared 48.9% YoY, reaching $95.3 billion.

Key metrics:

- 62.2 million monthly active MoMo users

- Lending volume: $592.7 million (up 80.3%)

- Remittances: $1.4 billion (up 74.9%)

- MoMo virtual card rollout in Uganda & Rwanda via Mastercard

MTN’s ongoing fintech separation strategy, especially in Nigeria, Ghana, and Uganda, is expected to unlock even more shareholder value and create standalone digital finance champions under the MTN brand.

Data and Digital Drive Continues

Data remains a cornerstone of MTN’s growth narrative. In Q1 2025:

- Data revenue grew 28.7%.

- Traffic increased 30.4%.

- Active data users hit 161.7 million, a 9.1% increase.

In Nigeria, the rising demand for high-speed connectivity, along with MTN’s expanded home broadband and 5G initiatives, continues to fuel ARPU (Average Revenue Per User).

Satellite & Infrastructure Innovations

MTN is actively pursuing network sharing in Nigeria and Uganda and partnering with LEO satellite providers like Starlink and Lynk to reach underserved rural areas.

The company even conducted Africa’s first satellite-to-phone trial, signalling a new phase of connectivity.

Strategic Clarity, Financial Discipline

MTN Group is maintaining a net debt-to-EBITDA ratio of 0.7x, and its liquidity headroom stands at R38 billion (about $2.09 billion). With a full-year CAPEX target of R30–35 billion ($1.65–1.925 billion), the company is balancing bold investment with smart capital allocation.

Group CEO Ralph Mupita summed it up perfectly:

“We are executing with discipline and investing with purpose to unlock digital and financial inclusion across Africa.”

READ ALSO:

Why the Airtel SpaceX Deal Is Not Just Another Satellite Project

What Lies Ahead

Looking to Q2 and beyond:

- South Africa’s prepaid recovery is a focus.

- Recently approved pricing adjustments in Nigeria are expected to support top-line growth.

- Continued fintech separation and monetisation are likely to attract investor interest.

As MTN continues to double down on core markets and digital ecosystems, its financial outlook is being redefined, not just by telecom performance, but by its strategic dominance in fintech and digital infrastructure across Africa.

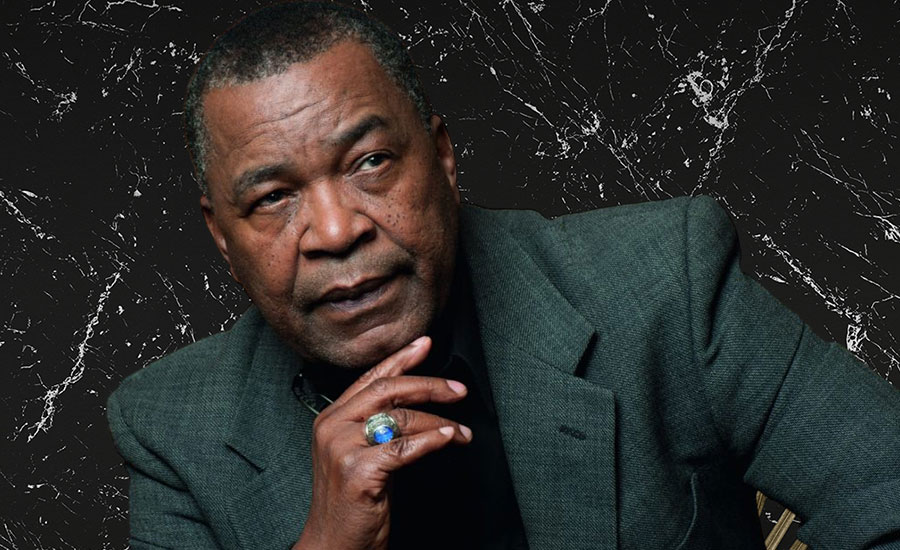

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, and digital finance at Africa Digest News.

Leave a Reply