Digital payments are transforming the financial landscape in Africa, and PawaPay, a leading mobile money platform, is at the forefront of this movement.

Recently, PawaPay announced a significant milestone, reaching 1 billion transactions while expanding its services into underserved African markets with high potential for tech adaptability.

What is PawaPay? A Game-Changer in African Digital Payments

Launched in 2020, PawaPay has quickly become a key player in Africa’s fintech ecosystem. The platform’s API seamlessly integrates various mobile money wallets, enabling businesses to make instant, cost-effective payouts across 18 African countries.

From mature digital payment markets like Kenya, Nigeria, Egypt, and South Africa to emerging markets such as the Democratic Republic of Congo (DRC), Uganda, and Cameroon, PawaPay is bridging the gap in financial inclusion.

The company’s focus on merchant-first solutions has been a cornerstone of its success.

As Nikolai Barnwell, CEO of PawaPay, stated, “We saw an opportunity to become an enabler for businesses in countries ripe for digital payment solutions but often underserved by other providers. We’ve been laser-focused on delivering a reliable, merchant-first product, and that’s what’s made all the difference.”

READ ALSO:

Why Did Cross Switch Pick Pesawise to Break Into Kenya?

A Milestone Worth Celebrating: 1 Billion Transactions and Counting

PawaPay’s achievement of 1 billion transactions in just four years since its launch is a testament to the growing demand for mobile money solutions in Africa.

But the company isn’t stopping there. Just eight months after hitting this milestone, PawaPay is already approaching 2 billion transactions. In the last month alone, the platform facilitated over 16 million payouts with an impressive success rate of 99.37% and a median transaction speed of 1 second.

“Our upcoming milestone of 1 billion transactions isn’t just a celebration of the achievements of our merchants but a testament to the potential across the entire continent,” Barnwell added.

This rapid growth highlights the increasing reliance on mobile money for both businesses and consumers, as well as PawaPay’s ability to deliver fast, reliable, and scalable solutions.

Why Mobile Money is Thriving in Africa

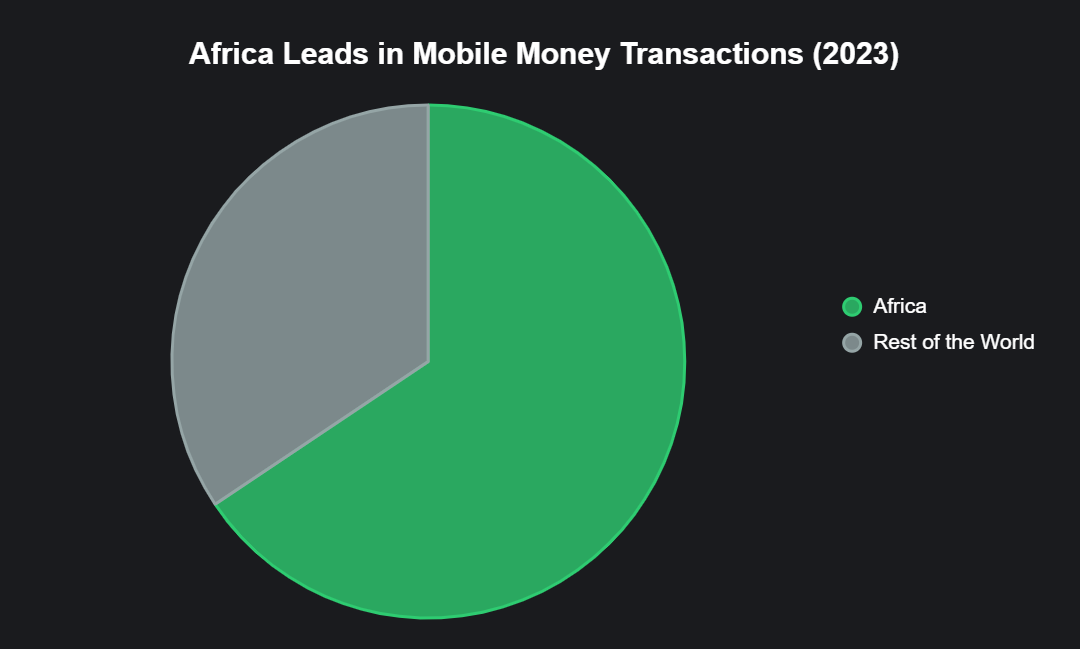

Africa leads the world in mobile money transactions, with 62 billion transactions recorded in 2023, accounting for 65.6% of the global total, according to the GSMA State of the Industry Report.

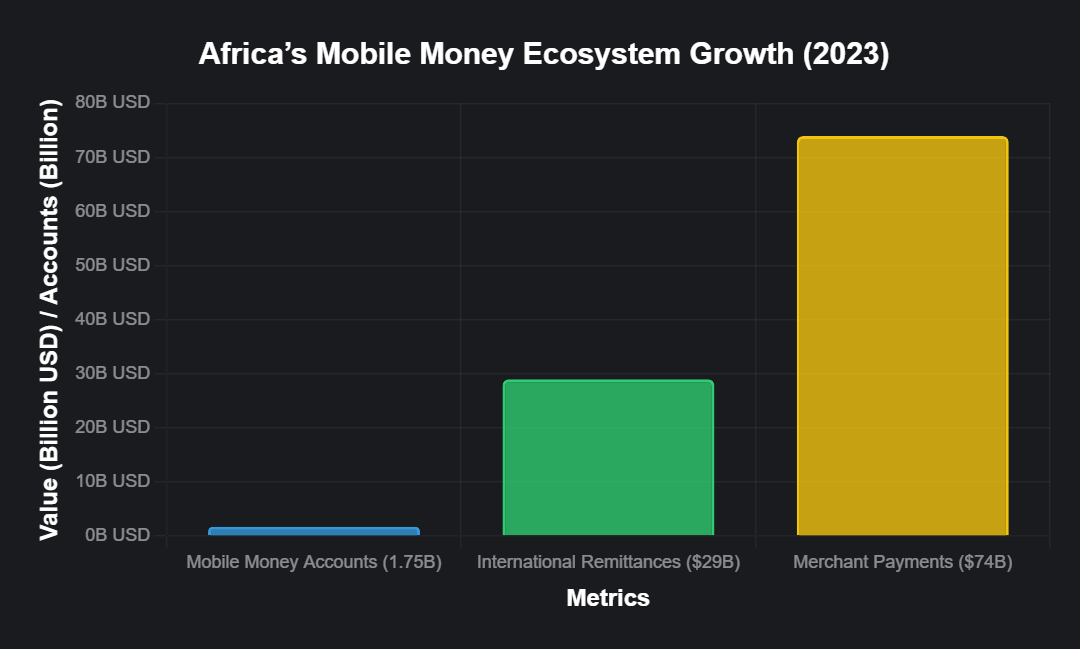

The continent also saw significant growth in mobile money accounts, which increased by 12% to 1.75 billion in 2023. Transaction values for international remittances via mobile money reached nearly $29 billion, while merchant payments grew by 14% to approximately $74 billion.

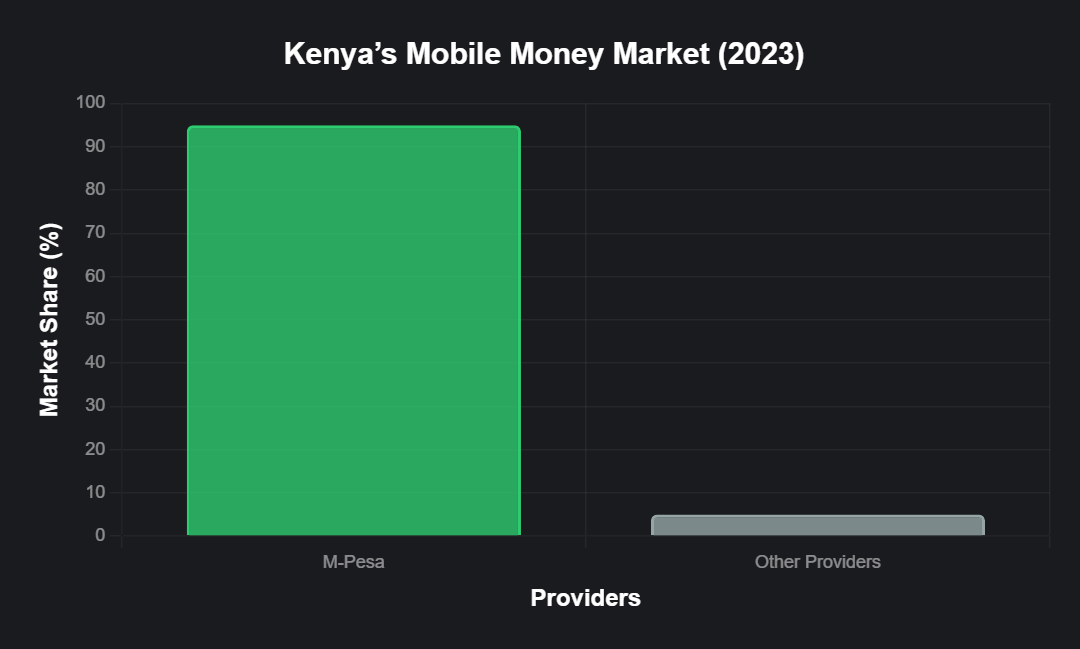

In Kenya, a pioneer in mobile money adoption, the market hit $133.2 billion in 2023, with M-Pesa dominating over 95% of the market share.

This success has attracted fintech companies like PawaPay, which are developing dashboards to connect fragmented mobile money solutions and create a more unified payment ecosystem.

Despite Africa’s lag in global digital literacy, mobile money’s simplicity,allowing users to send and receive cash without technical complexity,has made it an inevitable channel for financial transactions.

PawaPay’s Expansion Strategy: Targeting Underserved Markets

While PawaPay has seen significant success in established markets like Kenya and Nigeria, the company is now focusing on “forgotten” African countries where competition is low and opportunities are abundant.

Markets like the DRC, Uganda, and Cameroon have shown a strong demand for mobile money payments, prompting PawaPay to double down on its expansion efforts in these regions.

This strategic move aligns with the company’s mission to empower businesses in underserved areas. By offering a reliable and cost-effective payment solution, PawaPay is helping merchants tap into new customer bases and drive economic growth in regions that have been overlooked by other providers.

How PawaPay’s API is Powering Business Growth

PawaPay’s API is the backbone of its operations, enabling businesses to integrate multiple mobile money wallets into a single platform.

This allows for seamless, instant payouts across different countries and currencies, reducing the cost and complexity of cross-border transactions.

For businesses operating in Africa, this is a game-changer, as it eliminates the need to navigate fragmented payment systems.

The platform’s high success rate (99.37%) and lightning-fast transaction speed (1 second median) ensure that both businesses and customers can rely on PawaPay for their payment needs.

Whether it’s a small merchant in Uganda or a large enterprise in South Africa, PawaPay’s technology is enabling businesses to scale efficiently while meeting the growing demand for digital payments.

READ ALSO:

What KCB Group’s $15M Investment in Riverbank Solutions Means for the Future of Payment Solutions

Funding and Future Growth

In 2021, just one year after its launch, PawaPay secured $9 million in seed funding to fuel its expansion across Africa. This investment has allowed the company to scale its operations, enhance its technology, and enter new markets.

With 1.7 billion successful transactions completed between businesses and customers, PawaPay is not only celebrating its achievements but also looking ahead to even greater milestones.

As the company continues to innovate, its focus on underserved markets and merchant-first solutions will likely drive further growth.

By addressing the unique challenges of Africa’s digital payment landscape, PawaPay is positioning itself as a leader in the continent’s fintech revolution.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, and digital finance at Africa Digest News.

Leave a Reply