Safaricom’s M-Pesa has partnered with ADI Foundation to integrate blockchain technology through ADI Chain, a regulatory-compliant Layer 2 blockchain developed in Abu Dhabi.

This strategic agreement, announced on January 8, 2026, extends advanced digital payment capabilities to M-Pesa’s extensive user base of over 60 million monthly active users across eight African markets: Kenya, the Democratic Republic of the Congo, Egypt, Ethiopia, Ghana, Lesotho, Mozambique, and Tanzania.

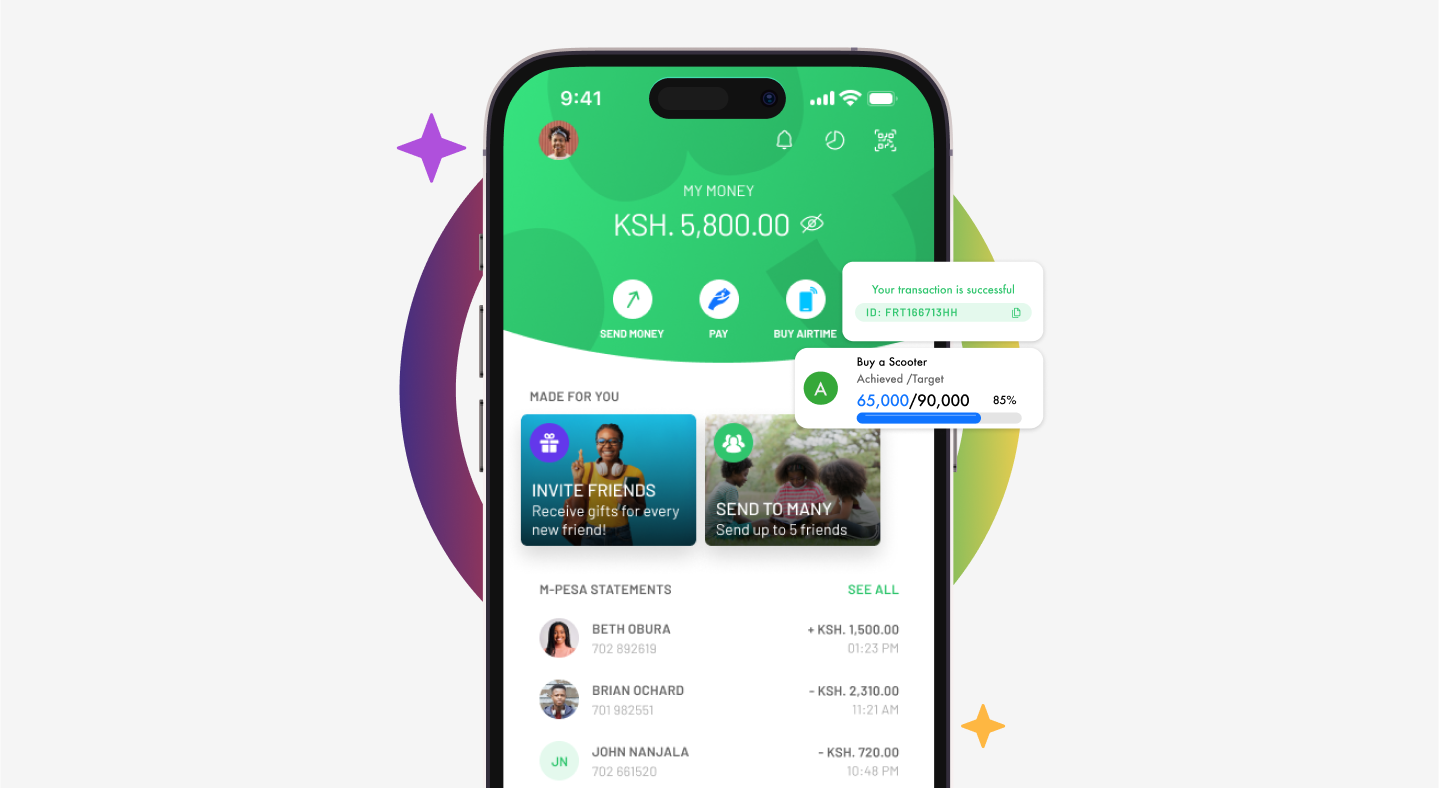

M-Pesa mobile money interface, illustrating the platform’s widespread adoption in Africa.

The integration enables faster cross-border payments and introduces stablecoin transactions, initially pegged to assets such as the UAE Dirham, allowing users to hedge against local currency fluctuations while upholding regulatory compliance and financial inclusion principles.

The Partnership and Technical Integration

The collaboration links M-Pesa’s robust mobile money ecosystem to ADI Chain, which prioritises compliance, efficiency, and security for institutional and emerging-market applications.

This connection supports seamless, secure data exchange and transaction processing without disrupting existing user experiences.

ADI Foundation and ADI Chain visuals, representing the blockchain infrastructure enabling the partnership.

A planned UAE Dirham-backed stablecoin, regulated by the UAE Central Bank and issued by First Abu Dhabi Bank and IHC, will settle on ADI Chain, providing a compliant framework for digital asset incorporation into mobile money platforms.

Sitoyo Lopokoiyit, CEO of M-Pesa Africa, remarked, “We are excited to partner with ADI Foundation to tap into their expertise around new technologies and how these can transform financial services.”

Huy Nguyen Trieu, board member of the ADI Foundation, added, “This partnership will push financial inclusion further by providing the right digital infrastructure.”

READ ALSO:What Are the Costs and Benefits of Non-Custodial Stablecoin Platforms for African Remittances?

Benefits for Users and Financial Inclusion

With approximately 42% of adults in sub-Saharan Africa remaining unbanked by conventional systems, this initiative addresses critical barriers in remittances and payments.

Stablecoin-enabled transactions reduce costs and delays in cross-border transfers while offering protection against currency volatility through asset-pegged digital instruments.

The partnership builds on M-Pesa’s foundational role in promoting access to financial services, extending blockchain advantages to everyday users via familiar mobile interfaces.

Rollout and Broader Implications

Implementation will occur in phases, commencing with selected corridors to ensure smooth execution and adherence to local regulations. This approach positions M-Pesa as a practical bridge between traditional mobile money and global blockchain networks.

Depictions of blockchain and mobile money convergence shaping digital payments and economic inclusion in Africa.

The development reflects increasing interest in stablecoins for trade and remittances across the continent, potentially setting a precedent for regulated blockchain adoption in emerging markets.

By facilitating faster, more stable cross-border payments and introducing hedging options, it enhances financial access for millions while aligning with regulatory standards.

This measured advancement holds significant potential to narrow the divide between conventional mobile money and blockchain-based systems.

For the latest updates on the phased rollout and specific features, consult official communications from M-Pesa Africa and the ADI Foundation.

ADI Foundation Oveview

ADI Foundation CEO has been central to shaping the organisation’s vision as ADI Foundation crypto initiatives expand across blockchain-based finance and digital asset innovation.

Public interest has also grown around Adi Foundation Blumberg references, particularly in relation to governance, partnerships, and thought leadership within the ecosystem.

At the technology layer, ADI Chain underpins these efforts by supporting decentralised applications and token utility, which has fuelled discussions around ADI token price prediction and broader market sentiment regarding ADI coin price as adoption and use cases continue to develop.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, and digital finance at Africa Digest News.

Leave a Reply