South African fintech firm Stitch, a leading provider of online payment infrastructure, has announced the acquisition of ExiPay, a renowned player in the in-person payment solutions market.

This strategic move aims to solidify Stitch’s position as a dominant force in the South African payments landscape by offering a comprehensive, unified platform that seamlessly integrates both online and in-person payment capabilities.

The acquisition brings ExiPay’s team of six seasoned professionals under the “Stitch In-person payments” brand. This integration will enable Stitch to effectively serve its existing roster of enterprise clients, including prominent names such as Bash, MTN, Cell C, and MultiChoice, by addressing a critical gap in their in-person payment offerings.

Founded in 2019, Stitch has attracted significant investor support, having raised a substantial $52 million in capital. With ambitious expansion plans on the horizon, the company is targeting entry into key African markets, including Nigeria, Kenya, Ghana, and Egypt.

The acquisition of ExiPay significantly strengthens Stitch’s product portfolio, enabling it to provide its enterprise customers with an omnichannel payment solution that caters to the evolving demands of the modern consumer.

READ ALSO:

Instant Loans and More Product Offerings for Underbanked Users in Egypt in An Equity Deal by Raseedi

The Rise of Omnichannel Payments:

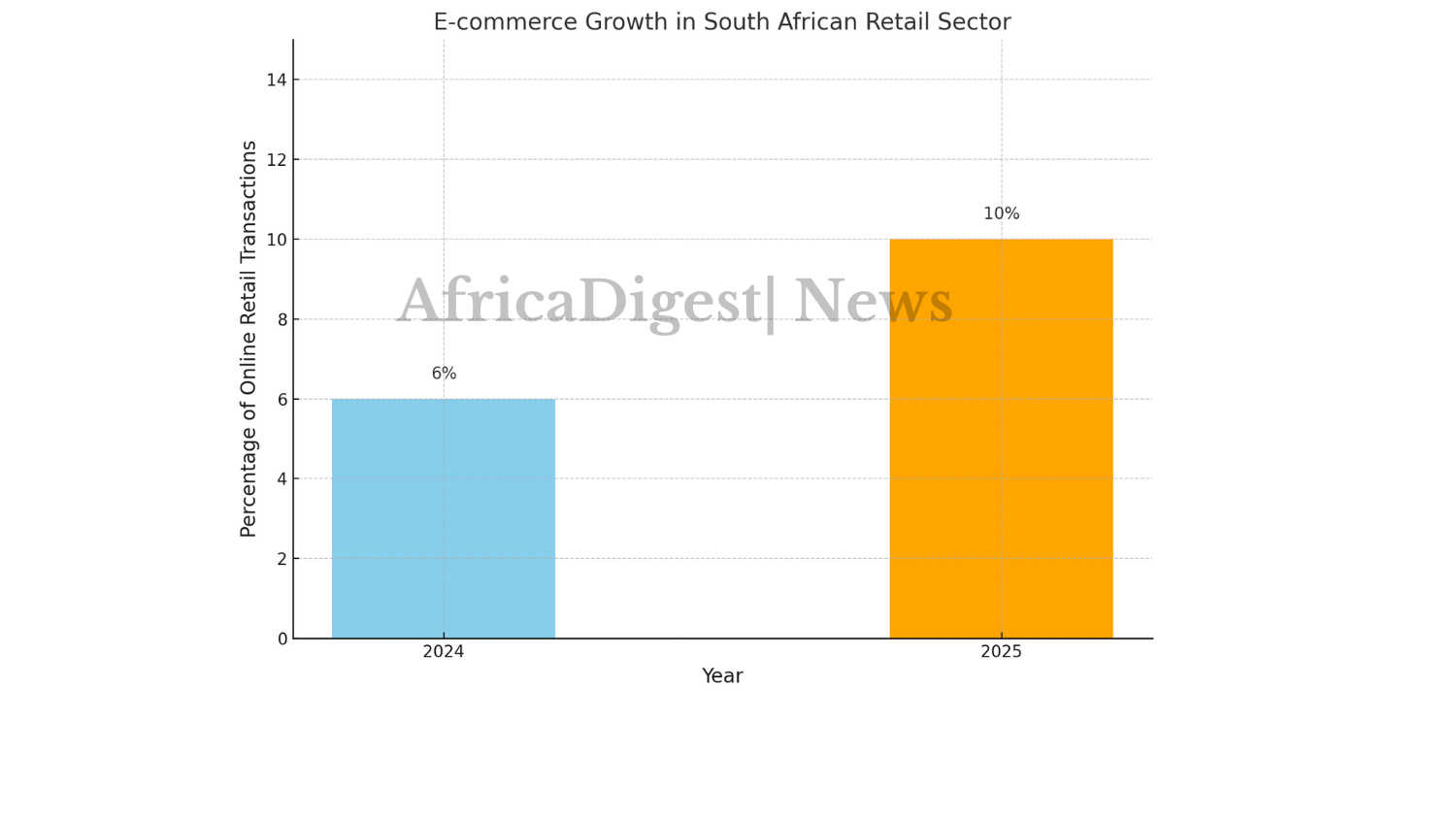

Despite the steady growth of e-commerce, the physical retail sector remains a cornerstone of the South African economy. In 2024, only 6% of retail transactions occurred online, although this figure is projected to reach 10% in 2025.

However, a growing number of consumers express a strong preference for brands that offer both physical and online shopping experiences. This evolving consumer behaviour highlights the critical need for seamless and integrated omnichannel payment solutions.

By acquiring ExiPay, Stitch is directly addressing this market demand. The company recognises the increasing consumer expectation for personalised and unified experiences across all touchpoints, regardless of whether they are shopping online or in-store.

This acquisition positions Stitch to become a preferred partner for businesses seeking to enhance their customer experience and drive growth through a truly omnichannel approach.

Key Benefits of Stitch In-Person Payments:

- Unified Platform: Seamlessly manage both online and in-person payments through a single, integrated platform.

- Omnichannel Flexibility: Offer customers the option to pay with various online methods, including digital wallets, at the point of sale.

- Device Compatibility: Utilise existing terminals or leverage Stitch to certify new devices, including P2PE-certified terminals.

- Bank interoperability: Support for all major acquiring banks ensures flexibility and choice for merchants.

- Easy Integration: Simple integration process with the same flexibility, reliability, and white-glove support enjoyed by existing Stitch online payments clients.

Expanding Reach and Serving Existing Clients:

ExiPay brings a strong client base and established partnerships with key players in the South African and broader African markets. Notably, Stitch will now serve Bash/The Foschini Group (TFG), a leading omnichannel retail brand, for both their online and in-person payment needs.

What does this partnership mean for you?

As a Bash customer, you can expect several improvements to your payment journey:

- More Ways to Pay: Whether you’re shopping online or in-store, you’ll have a wider range of payment options to choose from. Stitch’s integration allows Bash to offer a variety of payment methods, ensuring you can always find a convenient way to complete your purchase.

- Streamlined Operations: The partnership between Bash and Stitch aims to streamline the payment process, minimising friction and delays. This translates to a smoother and faster checkout experience for you.

- Improved Payment Success Rates: Stitch boasts a highly reliable card solution with direct integrations to multiple banks and networks. This robust infrastructure translates to fewer declined transactions and a more successful payment experience for you.

READ ALSO:

Beltone Capital’s Strategic Move into African Lending Market with Baobab Acquisition

Everything You Need to Know About Stitch South Africa and Stitch Money

Stitch is a prominent financial services company with a growing presence, including the Stitch South Africa office, which serves as a hub for innovative solutions.

For anyone seeking assistance, the Stitch South Africa contact details are readily available on their official platforms. Many customers often search for Stitch South Africa reviews to gauge user experiences before engaging with their services.

If you need to reach out, the Stitch South Africa contact provides direct communication options. Additionally, the Stitch South Africa app offers convenient financial management features.

For further enquiries, Stitch Money contact details can be found online, alongside the Stitch Money address for physical visits. Notably, the Stitch Money offices Cape Town location continues to be a key operational base for their services.

Ready to Get Started?

If you’re a business owner interested in learning more about how Bash and Stitch can transform your payment experience, visit sales@stitch.money to get in touch with their sales team.

This partnership between Bash and Stitch signifies a significant step forward in the payments landscape. By prioritising reliability, flexibility, and customer convenience, this collaboration is positioned to benefit both consumers and businesses alike.

Leave a Reply