ADCB Egypt has gone live with Temenos Payments Hub, enabling the processing of SWIFT payments using the ISO 20022 MX messaging standard for both retail and corporate customers.

Announced on January 28, 2026, this implementation, executed in collaboration with Temenos delivery partner ITSS, marks a significant step in modernising the bank’s payments infrastructure and accelerating its digital transformation objectives.

As a subsidiary of Abu Dhabi Commercial Bank Group, ADCB Egypt benefits from an existing Temenos Core banking platform.

The integration of Temenos Payments Hub creates a unified environment that enhances operational efficiency, supports richer data structures, and positions the bank to meet evolving global payment standards.

Core Benefits of the Temenos Payments Hub Implementation

The solution introduces ISO 20022-compliant messaging, which provides structured, data-rich formats compared to legacy MT messages.

This advancement delivers several operational improvements:

- Higher straight-through processing (STP) rates, minimising manual interventions and associated errors.

- Faster settlement times through automated reconciliation and end-to-end visibility.

- Centralised orchestration for comprehensive oversight and control of payment flows.

- Scalable architecture capable of handling increasing transaction volumes and accommodating future payment types within a single enterprise hub.

These enhancements improve accuracy, interoperability, and resilience, enabling ADCB Egypt to deliver more efficient cross-border and domestic payment services to its clients.

Digital transformation is a key priority for ADCB Egypt and a key pillar of our long-term growth agenda.

Ihab Elswerkey, CEO and Managing Director of ADCB Egypt

Going live with Temenos Payments Hub reflects our continued investment in advanced, scalable technologies that enhance efficiency, resilience, and customer experience.

Strategic and Regional Significance

The deployment aligns with Egypt’s Vision 2030, which emphasises strengthening financial infrastructure and fostering a digitally driven banking ecosystem.

READ ALSO:Why ABSA and FirstRand Are Betting Big on Blockchain With SWIFT

By adopting ISO 20022-ready capabilities, ADCB Egypt positions itself at the forefront of payments innovation in the Egyptian market, facilitating smoother integration with international networks and supporting the country’s broader economic modernisation efforts.

This milestone positions ADCB at the forefront of payments in the Egyptian market and showcases how banks across the region can swiftly adapt to change and deliver the modern payment services their customers increasingly demand

Santhosh Rao, Managing Director – MEA at Temenos

As a trusted Temenos partner, ITSS is proud to support ADCB Egypt in advancing its digital payments strategy. This successful go-live demonstrates how, together with Temenos, we help forward-thinking institutions accelerate innovation, scale efficiently, and set a new benchmark for digital payments in the region.

Patrick Jaccoud, CEO of ITSS

Looking Ahead

ADCB Egypt’s successful deployment of Temenos Payments Hub represents a strategic advancement in payments modernisation, leveraging ISO 20022 standards to achieve greater efficiency, transparency, and scalability.

Integrated with the bank’s existing Temenos Core platform, the solution strengthens service delivery for retail and corporate clients while aligning with national priorities for digital financial infrastructure.

As of January 30, 2026, this initiative sets a benchmark for regional banks seeking to enhance cross-border capabilities and operational resilience. For further details, consult official announcements from Temenos and ADCB Egypt.

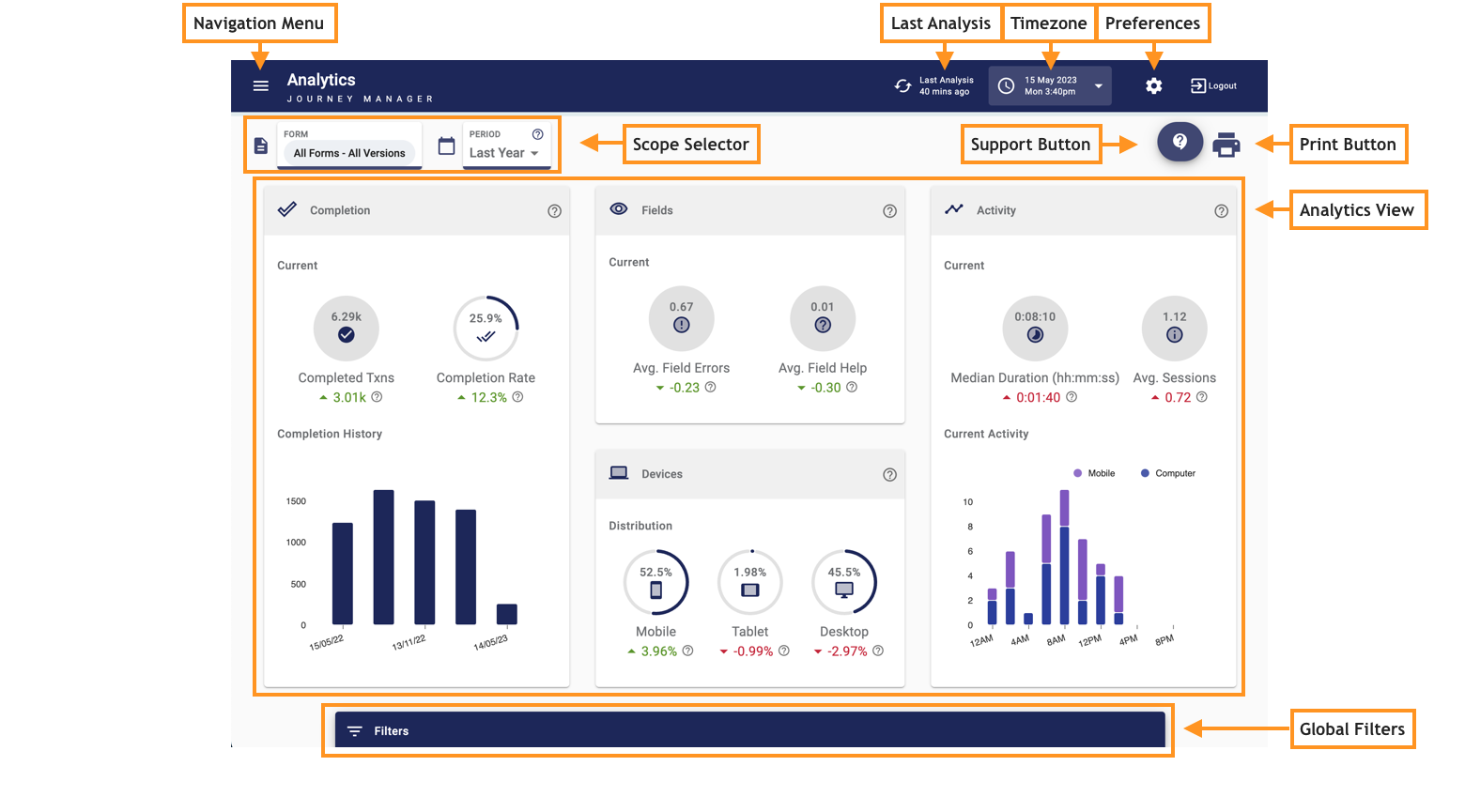

Temenos Payment Hub Overview

Temenos Payment Hub (often called TPH) is a unified payments processing platform used by banks to handle domestic, cross-border and real-time payments, with configurable workflows and support for instant payment schemes.

Training for Temenos Payment Hub is available through Temenos training and certification paths that include foundational and implementation modules for TPH, requiring completion of specific courses to become certified in the product.

The Temenos Payment Hub architecture is built to centralise payment processing across types (batch, real-time, domestic, international) with open APIs, flexible components and integration points into a core banking platform like Temenos Transact (T24).

The platform isn’t a standalone “app” in the consumer sense, but institutions typically interact with it via internal dashboards or through integrated front-end channels developed on top of the hub.

Temenos supports Temenos instant payments as part of its payments suite, enabling real-time messaging and settlement for schemes such as Faster Payments or SEPA Instant when connected to TPH.

Temenos Transact is the modern core banking system (also known as T24), widely used by banks for account management, deposits, loans, customer data and more, and often paired with Payment Hub for complete banking and payments processing.

The Temenos T24 core banking modules cover areas such as customer onboarding, account management, deposits, lending, transaction processing and reporting, forming the backbone of digital banking operations.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, climate change, and digital finance at Africa Digest News.

Leave a Reply