Airtel Money and Diamond Trust Bank (DTB) unveiled a partnership allowing users to pay any DTB Till Moja merchant via Paybill 516600 with a 50% airtime cashback on every transaction.

For users fighting 7% inflation, it’s stretch-your-shilling magic; for SMEs, it’s faster collections with no extra hardware.

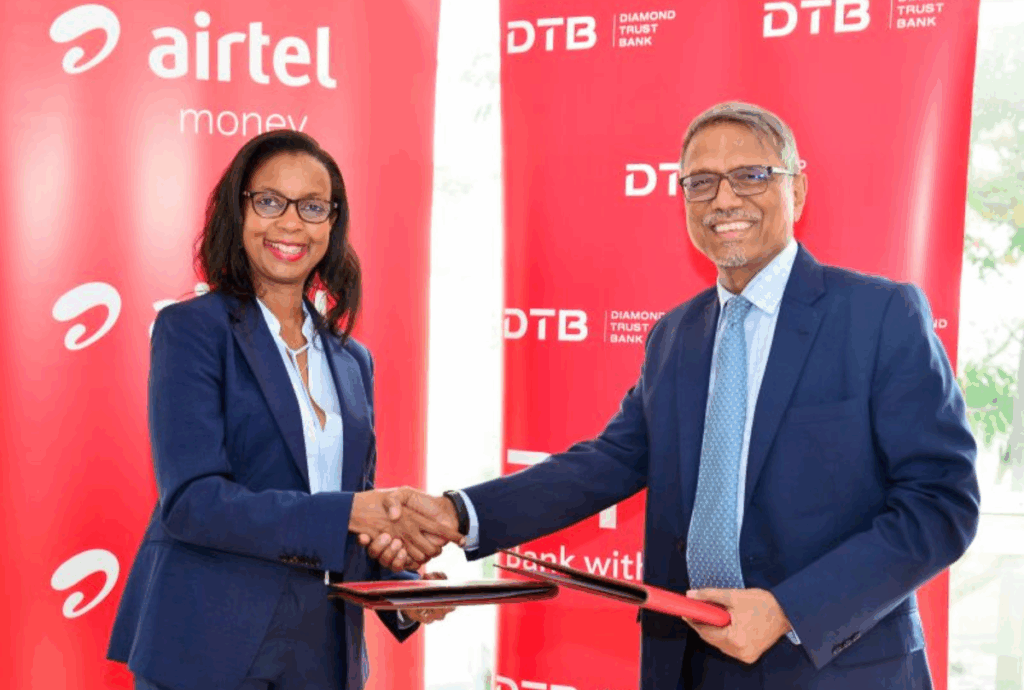

Airtel Money MD Anne Kinuthia-Otieno summed it up: “This makes payments simpler and more rewarding for everyone.” DTB Group CEO Murali Natarajan echoed the inclusion arc: “We are opening up easier, more accessible banking for SMEs and individuals.”

With Airtel Money’s market share surging to 9.1% in Q1 2025, up from 5.1% two years earlier, this deal is a direct strike at the rails long dominated by M-Pesa’s 96.5% merchant chokehold.

Airtel Money, now commanding 12 million users and 110,000+ agents, has built its growth on value: zero-fee promotions, network-wide rebates, and faster bank linkages.

Its 2024 transaction value hit Sh1.2 trillion, up 25% year-on-year, powered in part by the runaway “Rudishiwa” 50% rebate campaign.

DTB, meanwhile, sits at the heart of Kenya’s SME economy. Its Till Moja platform launched in 2018 and now serving 50,000+ merchants lets businesses accept payments from Airtel Money, M-Pesa, and T-Kash using a single shortcode.

No point-of-sale terminal, no complicated setup, and instant settlement into business accounts.

This new partnership simply turns the tap wider: 1M+ DTB customers, thousands of SMEs, and Airtel Money’s swelling mobile base plus cashback that practically advertises itself.

Every time an Airtel Money user pays a DTB Till Moja merchant via Paybill 516600, they instantly earn 50% of the transaction fee back as airtime. No expiry, no small print.

Daily wallet limits of Sh500,000 apply, matching Airtel Money’s standard caps. Cashbacks reflect immediately in airtime balance. suitable for calls, SMS, or data.

| Scenario | Amount | Fee (Est. 1%) | Cashback (50%) | Net Cost | Why It Matters |

|---|---|---|---|---|---|

| Grocery run | Sh5,000 | Sh50 | Sh25 | Sh25 | Stretch your weekly spend amid 7% inflation |

| SME supplier payment | Sh50,000 | Sh500 | Sh250 | Sh250 | Merchants get instant settlement—no cash risk |

| Utility bills | Sh2,000 | Sh20 | Sh10 | Sh10 | Quick payments + data from cashback airtime |

For Kenya’s 40% informal economy, the impact is simple: digital payments get cheaper, SMEs get paid faster, and customers get rewarded.

READ ALSO:Airtel Money Users Can Now Make Global Payments with Virtual Card

How to Pay via 516600 (and Trigger Your Cashback)

Airtel Money has reduced the UX to the essentials. Users can pay and earn within seconds.

Via App:

Open the Airtel Money app → Pay Bill → Enter 516600 → Input merchant till number → Enter amount → Confirm. Airtime cashback lands instantly.

Via USSD:

Dial *334# → Select Lipa na Airtel Money / Pay Bill → Enter 516600 → Till number → Amount → PIN → Done.

You can track airtime in your balance; cashbacks have no expiry.

Note: Cashback applies to Paybill merchant payments only; peer-to-peer transfers aren’t included.

Pro move: Pair with the ongoing Rudishiwa rebates to effectively cut your total transaction cost even further.

This partnership lands as Kenya’s National Payments Strategy pushes the country toward 90% digital transactions by 2027, a shift expected to unlock $10B+ in efficiency gains. Airtel Money’s climb from 5.1% to 9.1% market share in two years shows cracks in Safaricom’s once-untouchable dominance, especially among rewards-driven young users.

For SMEs, Till Moja’s multi-wallet flexibility reduces cash handling by as much as 30%, trims reconciliation headaches, and plugs directly into DTB business accounts. For Kenya’s $50B informal sector, this is friction removed at scale.

With projections pushing Airtel Money toward 12% market share by 2026, partnerships like this are the acceleration lane.

Dial *334#, enter 516600, pay your next bill and watch the airtime build up.

Till Moja Overview

Till Moja Kenya is gaining traction through the Till Moja app, which enables streamlined merchant payments across the country. Alongside this, Airtel Money Africa continues expanding digital finance access, supported by the Airtel Money app download options, the Airtel Money login portal, and responsive assistance via the Airtel Money customer care number. Airtel Money Kenya users also frequently rely on cross-network services like Airtel Money to M-PESA, reinforcing seamless mobile money interoperability.

Leave a Reply