Nigeria’s mandatory e-invoicing framework, effective from January 1, 2026, for medium and small VAT-registered businesses (following earlier phases for large taxpayers), requires all taxable persons to issue, validate, and report invoices through the Nigeria Revenue Service (NRS) platform, formerly known as the Federal Inland Revenue Service (FIRS) Merchant Buyer Solution (MBS).

This initiative enhances transparency, standardises processes, and strengthens revenue collection under the recent tax reforms.

Heirs Technologies, accredited by the NRS as a system integrator for the MBS, enables businesses to connect existing invoicing and enterprise systems seamlessly to the national platform, facilitating compliance with minimal disruption.

Overview of Nigeria’s e-Invoicing Mandate

As of January 10, 2026, the e-invoicing requirement applies to VAT-registered entities across B2B, B2G, and B2C transactions (with specific reporting for B2C).

Invoices must be generated in structured formats (such as XML or JSON compliant with BIS Billing 3.0 UBL standards), validated in real-time by the NRS, and include cryptographic stamps for authenticity.

Non-compliance may result in penalties, disallowed input VAT claims, and operational challenges.

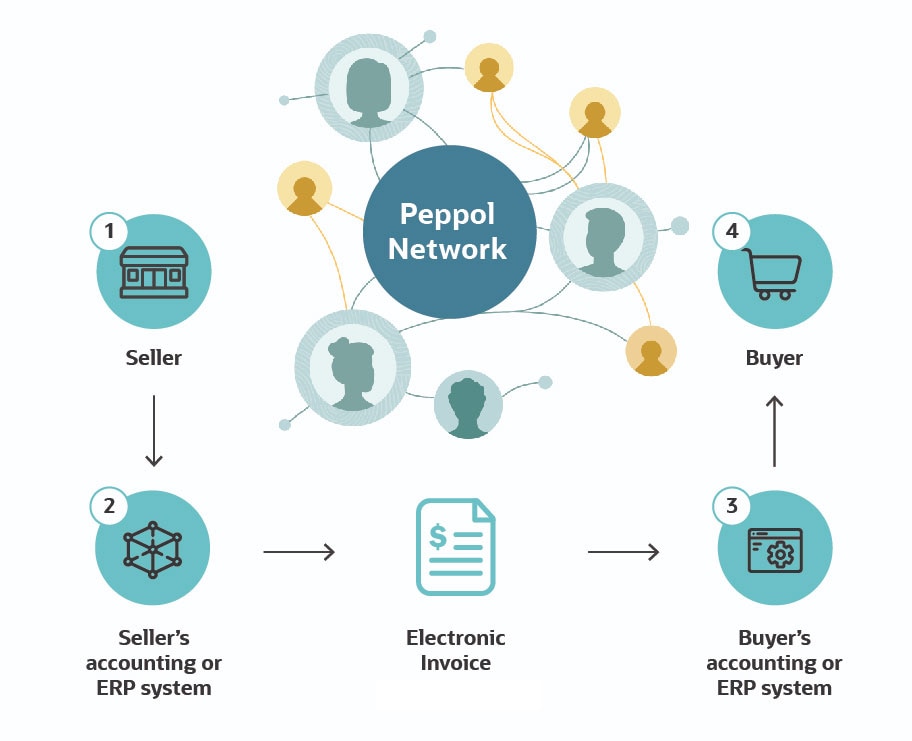

System integrators, accredited by the National Information Technology Development Agency (NITDA) in coordination with the NRS, serve as authorised intermediaries.

They handle integration between a company’s ERP or accounting software and the MBS platform, ensuring secure data exchange, validation, and automated reporting.

Role of NRS-Accredited System Integrators

Accredited system integrators provide the technical bridge for compliance. They enable direct connection of corporate systems to the national e-invoicing infrastructure, supporting invoice issuance, real-time clearance, and regulatory submissions. This approach avoids manual processes and reduces errors.

Heirs Technologies, as a recently accredited provider (announced in early January 2026), offers comprehensive services including readiness assessments, system integration, validation, and ongoing support.

The company integrates with existing ERP and accounting systems while incorporating tax expertise to ensure alignment with NRS requirements.

Heirs Technologies branding and visuals highlighting its role in digital transformation and e-invoicing compliance.

George Njuguna, Chief Technology and Innovation Officer at Heirs Technologies, noted: “E-invoicing is a compliance requirement that spans finance, tax, operations, and technology. Successful implementation needs both strong integration skills and clear regulatory knowledge.”

Steps for Compliance Using Accredited Integrators

Nigerian companies can achieve compliance through the following structured process:

- Assess Readiness: Conduct an evaluation of current invoicing and ERP systems to identify compatibility gaps.

- Engage an Accredited Integrator: Select an NRS/NITDA-accredited provider, such as Heirs Technologies, for expert guidance.

- Integrate Systems: Connect enterprise systems to the MBS platform via APIs or secure channels, enabling automated invoice generation and transmission.

- Register and Validate: Complete NRS portal registration using the Taxpayer Identification Number (TIN), then test invoice flows for validation and clearance.

- Implement and Monitor: Deploy the solution, train staff, and establish ongoing monitoring for compliance and updates.

Diagrams showing ERP system integration with e-Invoicing platforms for seamless compliance.

This method ensures low-disruption adoption, with integrators handling technical complexities while businesses focus on core operations.

READ ALSO:Is PiggyVest Approved by CBN and Safe for Nigerians to Save?

Benefits of Partnering with Accredited Providers

Utilising accredited integrators like Heirs Technologies minimises risks, enhances efficiency, and supports broader digital transformation.

Solutions maintain data security in line with the Nigeria Data Protection Act and provide scalability for future regulatory changes.

Nigerian companies can effectively comply with the e-invoicing mandate by leveraging NRS-accredited system integrators, which facilitate seamless integration and regulatory adherence as of January 10, 2026.

Providers such as Heirs Technologies combine technical expertise with tax knowledge to deliver efficient, compliant solutions.

Businesses are advised to act promptly to avoid penalties and consult official NRS resources or accredited partners for tailored implementation. For the latest guidance, refer to the NRS website or contact authorised service providers directly.

Heirs technologies Overview

Heirs technologies careers attract professionals seeking opportunities in digital transformation, data, and enterprise technology, with many candidates also researching Heirs technologies salary structures as part of their employment considerations.

The company strengthens talent development through the Heirs technologies training centre and the Heirs technologies i academy, which focus on upskilling young professionals and experienced practitioners with industry-relevant digital and technology competencies aligned to Africa’s growing tech ecosystem.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, and digital finance at Africa Digest News.

Leave a Reply