The Central Bank of Nigeria (CBN) has taken a decisive step towards sanitising the nation’s foreign exchange (FX) market with the launch of the Nigeria Foreign Exchange Code.

This comprehensive framework introduces six core principles designed to restore transparency, accountability, and trust in the FX market, marking a significant shift towards greater market integrity.

CBN Governor Olayemi Cardoso unveiled the Code in Abuja, emphasising its crucial role in addressing past malpractices and preventing future systemic abuses.

He stressed that the Code establishes clear and enforceable standards, targeting the unethical practices that have characterised the Nigerian financial ecosystem and contributed to challenges like the $7 billion FX backlog, which is currently undergoing forensic verification.

Cardoso assured stakeholders that this verification process is nearing completion, with final settlements to follow.

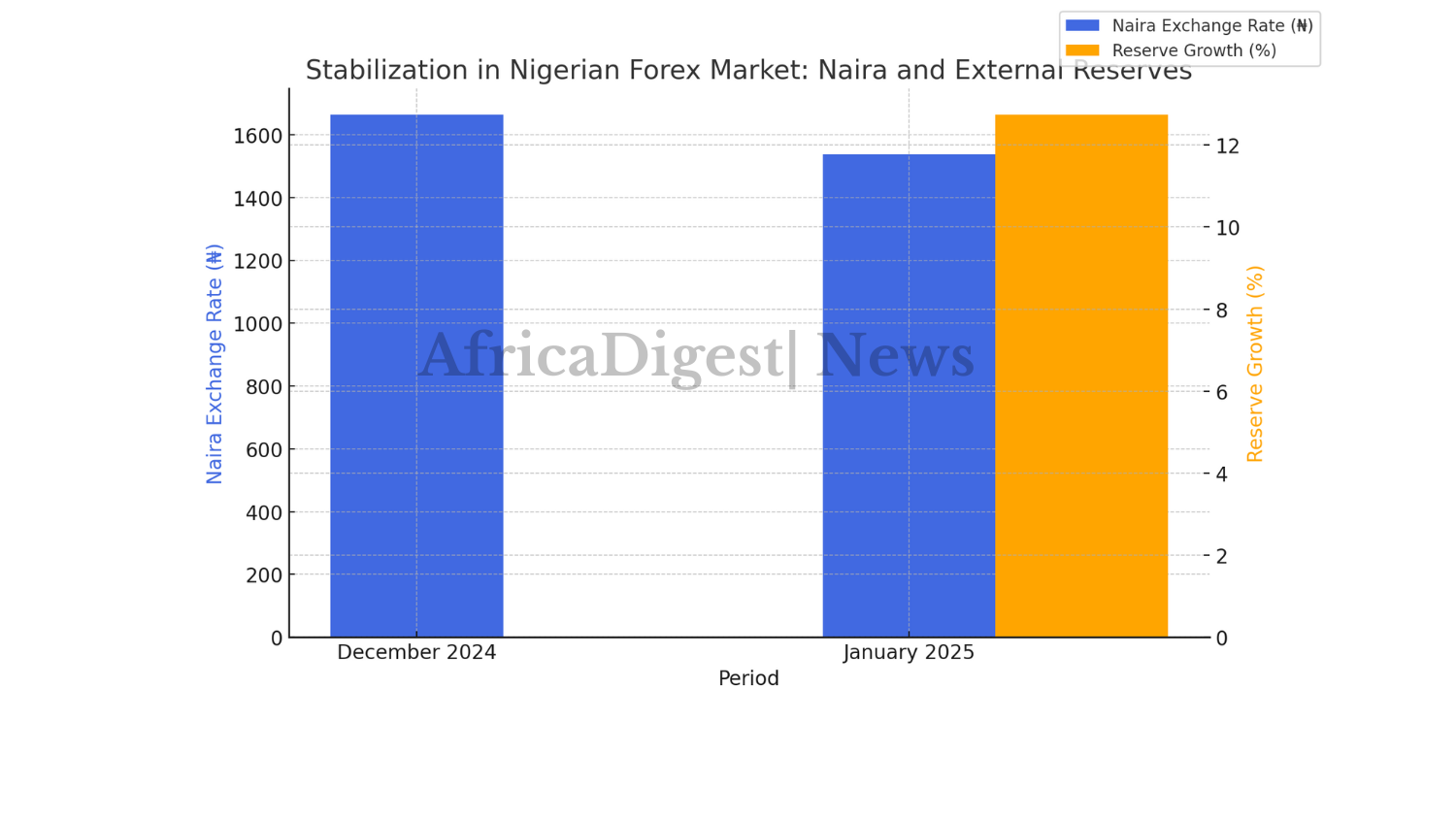

The Code’s arrival coincides with positive signs of stabilisation in the Nigerian forex market. The naira has appreciated from ₦1,663.90 to ₦1,536.72 since December 2024, and external reserves have grown by an impressive 12.74%, reaching $40.68 billion.

This positive momentum provides a strong foundation for the Code to take root and further enhance market stability.

READ ALSO:

Improved Connectivity and Service Reliability for Nigerian Customers with MTN Licence Renewal

Six Pillars of Transparency:

The Nigeria Foreign Exchange Code rests on six core principles:

- Ethics: Promoting ethical conduct and integrity in all FX transactions.

- Governance: Establishing robust governance frameworks for FX market participants.

- Execution: Ensuring efficient and transparent execution of FX transactions.

- Information Sharing: Facilitating timely and accurate information sharing among market participants.

- Risk Management: Strengthening risk management practices to mitigate potential vulnerabilities.

- Settlement Processes: Improving the efficiency and security of FX settlement processes.

Enforcement and Compliance:

In a move to further enhance transparency and ethical practices, the CBN has mandated compliance with the Nigeria FX Code. All participants in the foreign exchange market are required to submit self-assessment reports on their adherence to the Code by January 31, 2025.

These reports should detail the institution’s level of compliance and include a detailed compliance implementation plan approved and signed by its board, along with extracts of the relevant board meeting minutes.

Following the initial deadline, market participants will be required to submit quarterly compliance reports to the CBN’s Financial Markets Department, due within 14 days after the end of each calendar quarter.

The first of these quarterly reports is expected by March 31, 2025. Failure to adhere to the Code’s provisions will result in strict penalties under the CBN Act 2007 and BOFIA Act 2020, underscoring the CBN’s commitment to enforcing the new standards.

Building on Recent Reforms:

The FX Code builds upon other recent reforms implemented by the CBN, such as the Electronic Foreign Exchange Matching System (EFEMS).

These initiatives collectively aim to create a more transparent, efficient, and stable FX market, fostering confidence among investors and contributing to the overall health of the Nigerian economy.

By addressing past challenges and promoting ethical conduct, the CBN is paving the way for a more robust and reliable FX market in Nigeria.

READ ALSO:

Voice and Data Services Charges Rise Up by 50% for Nigeria’s Customers

Everything You Need to Know About the Central Bank of Nigeria

The Central Bank of Nigeria Governor plays a critical role in shaping the nation’s monetary policies and financial stability. Staying updated with the latest Central Bank of Nigeria news is essential for understanding key economic decisions and market trends.

For those seeking more information or assistance, the Central Bank of Nigeria address can be found at its headquarters in Central Bank of Nigeria Abuja.

One of the most significant aspects of its operations is the Central Bank of Nigeria exchange rate, which impacts trade and investments.

Many people often ask, “Who is the new governor of Central Bank of Nigeria?” or “Who is the current Governor of Central Bank of Nigeria 2024?”

Additionally, for historical insights, questions like “Who is the founder of Central Bank of Nigeria?” highlight the institution’s origins and leadership legacy.

Looking Ahead:

The introduction of the FX Code signals the CBN’s commitment to cleaning up the FX market and fostering a more sustainable economic environment.

The success of this initiative will depend on the commitment of all market participants to adhere to the code’s principles and the CBN’s resolve to enforce them.

Leave a Reply