Stitch and Capitec Bank switched on Capitec Pay Variable Recurring Payments (VRP): South Africa’s first API-driven VRP product and the clearest sign yet that the country is edging into genuine open banking.

With VRP, Capitec’s 25 million customers can approve a single, flexible spending mandate inside the bank’s app, setting a maximum amount after which businesses can pull variable charges directly from a bank account without card rails and without reauthorisations.

A grocery order that fluctuates week to week, a courier bill tied to weight, or a subscription that shifts tiers no longer triggers failed charges. Stitch’s early data shows success rates pushing 95%+, with cost savings of up to 50% compared to cards.

As Stitch President Junaid Dadan put it: “VRP removes the friction of recurring payments. Businesses collect more successfully; customers pay with bank accounts they already trust.”

It marks a turning point for Capitec Pay, which originally launched in 2023 as a simple pay-by-bank option but now becomes a full recurring-payments engine, one that could unlock more than R50 billion in efficient collections across the market.

Stitch has spent the last six years building the pipes for South Africa’s next-generation payments infrastructure.

Founded in 2019 by Junaid Dadan, Lilian Barnard and Byron Lotz, the company processes more than R100 billion annually for over a thousand enterprises, including e-commerce giants like Takealot and food platforms like Mr D. Its $107 million raise (headlined by a $55M Series B in April 2025) cemented its position as a full-stack payments gateway: cards, EFTs, wallets, DebiCheck, in-person rail via its ExiPay acquisition, and now the country’s first VRP layer.

Capitec, meanwhile, controls half of South Africa’s adult banking population. Its 25 million active clients give it the reach to shift behaviour at scale, especially when paired with a product that eliminates the recurring-payment pain point consumers know too well.

Executive Head Chris Zietsman framed VRP around empowerment: “Clients gain control and visibility over recurring commitments, while merchants get faster, more reliable collections.”

Together, Stitch and Capitec become a powerful combination: enterprise-grade APIs on one side and mass adoption and regulatory credibility on the other.

The result is near-instant mandates, long-term persistence and a direct route toward open banking maturity as PayShap continues to advance.

VRP, Explained: The End of Mandate Chaos

For years, South African businesses relied on DebiCheck for recurring collections, but its rigidity worked against the country’s fast-modernising commerce landscape.

DebiCheck requires fixed amounts, lengthy notices and frequent reauthentication adequate for monthly subscriptions but incompatible with the rise of variable transactions.

Delivery substitutions, dynamic logistics, usage-based billing and tiered digital products inevitably triggered failed payments.

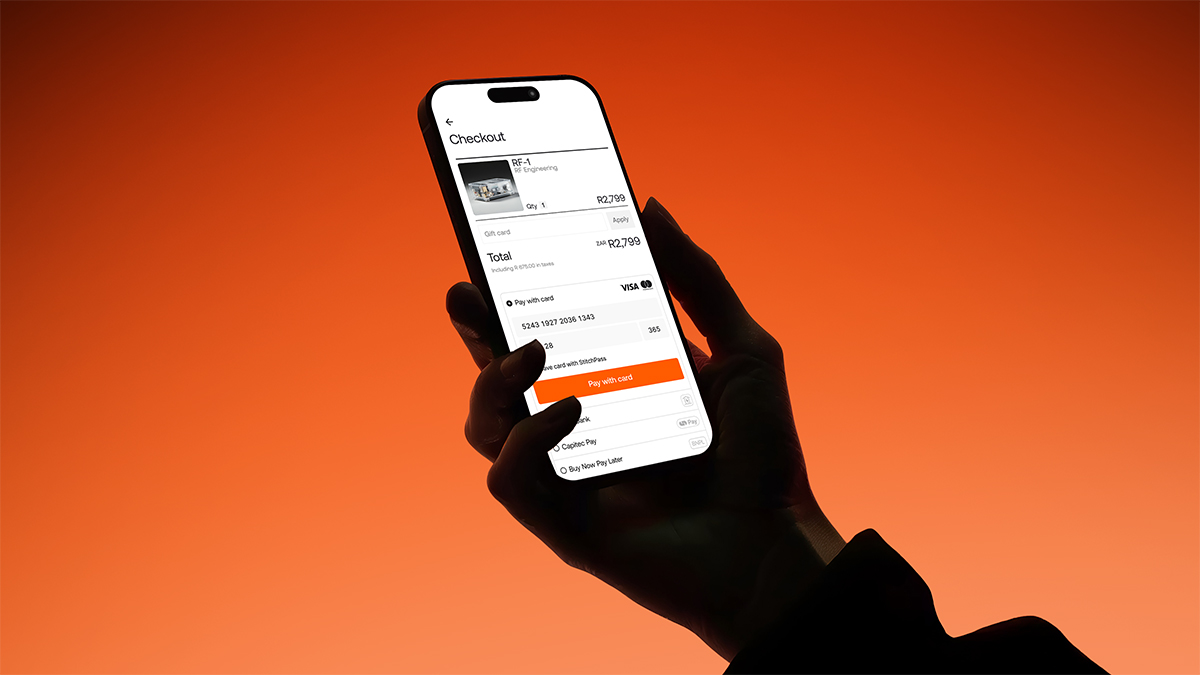

VRP reverses that logic. A customer approves a single maximum limit in the Capitec app, say, R1,000 per month for groceries after which the merchant can pull any amount up to that limit without further friction.

Customers can pause or cancel at any time. The entire setup takes about half a minute: select Capitec Pay at checkout, verify your mobile number, approve the maximum spend in-app, and you’re done.

Merchants get predictable, high-persistence collections; consumers get control without interruptions.

READ ALSO:Customers to Enjoy More Products with Online and In-Person Payment with Stitch Latest Acquisition

Where VRP Wins: A Comparison

| Legacy Recurring | VRP with Capitec + Stitch | Why It Matters |

|---|---|---|

| Fixed amounts only | Variable, flexible charges | Solves grocery, logistics, tiered services |

| Re-auth for every change | One max mandate | Fewer failures; consistent revenue |

| 3D Secure friction | In-app approval, no pop-ups | Higher conversion and retention |

| Card-dependent | Direct bank account debit | Reaches 60% of South Africans without credit cards |

| 85% average success | 95%+ success | Reduces retries and operational loss |

These mechanics open VRP to a wide range of use cases: groceries with substitutions, ride-hailing and logistics with weight-based pricing, insurance premium adjustments, usage-based utilities, and digital subscriptions that flex with consumption.

The Rollout: Live and Scaling

The product went live on 4 December 2025 across Stitch’s enterprise network, immediately making VRP available to some of the country’s busiest checkout flows.

Capitec’s 25 million users can activate VRP via app approval today, with expansion into utilities, contracts and government services slated for Q1 2026.

VRP lands at a pivotal moment. Cards still account for roughly 60% of South Africa’s digital payments, but failure rates driven by authentication hurdles, replacement cycles and fraud intercepts cost businesses more than R10 billion annually.

VRP’s high persistence, low fees and account-based rails plug directly into PayShap and line up cleanly with the Payments Industry Body’s 2027 open banking roadmap.

The inclusion effect is equally powerful. Many lower-income households rely on bank accounts but not cards; VRP extends recurring digital payments to millions who previously defaulted to cash or manual transfers.

For delivery and logistics merchants, the shift from card-on-delivery to account pulls could cut cash risk by 30% or more.

For South Africans tired of failed payments, pop-up loops, and card replacements, the fix is already here: open the Capitec app, set your maximum, and let the system handle the rest.

Capitec Pay Overview

Capitec Pay’s variable recurring payments limit allows customers and businesses to set flexible debit amounts for automated payments, while Capitec Pay variable recurring payments charges depend on transaction volumes and merchant agreements.

In fintech, variable recurring payments vs open banking highlights that VRPs are an advanced open-banking feature enabling automatic, consent-based payments with dynamic amounts.

For enterprises, commercial variable recurring payments offer businesses streamlined collections, reduced failed payments, and improved cash-flow automation.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, climate change, and digital finance at Africa Digest News.

Leave a Reply