Ziidi Money Market Fund (MMF) continues to be one of Kenya’s most accessible low-risk investment options, especially for M-Pesa users.

Launched in late 2024 by Safaricom in partnership with fund managers like Standard Investment Bank and ALA Capital Limited, Ziidi allows you to invest from as little as KSh 100 and earn competitive daily interest currently around 6.84% effective annual yield, computed and credited daily (after 15% withholding tax).

With over KSh 6 billion in assets under management and more than 450,000 investors, it’s a game-changer for everyday Kenyans looking to beat inflation without the hassle of paperwork.

Ziidi is regulated by the Capital Markets Authority (CMA) and fully integrated with M-Pesa, meaning all deposits, investments, and withdrawals happen seamlessly via your phone.

No bank visits required! Your funds start earning interest 24 hours after deposit, and you can withdraw instantly to your M-Pesa wallet (minimum KSh 10).

Transaction limits: KSh 250,000 per transaction and KSh 500,000 daily. Best of all, it’s zero-fee with no M-Pesa charges or maintenance fees.

Whether you’re a first-time investor in Nairobi or saving for school fees in Kisumu, here’s a simple, step-by-step guide to get started.

You can do this via the M-Pesa app (recommended for smartphones) or USSD (*334#) for feature phones.

READ ALSO:Latest Updates for September 2025 Ziidi MMF Interest Rates

Requirements

- An active Safaricom SIM with a registered M-Pesa account (at least 3 months old for full access).

- Sufficient balance in your M-Pesa wallet (start with KSh 100+).

- Your M-Pesa PIN (keep it secure and never share it!).

- Smartphone for the app method, or any phone for USSD.

Step 1: Download and Set Up the M-Pesa App (App Method)

- Go to your phone’s app store (Google Play for Android or App Store for iOS).

- Search for “M-PESA” and download the official app by Safaricom.

- Open the app and log in using your M-Pesa PIN. If it’s your first time, follow the prompts to activate with your Safaricom number.

Pro Tip: Enable notifications for real-time updates on your earnings and rates.

Step 2: Access Ziidi MMF

- App Method: Once logged in, tap the “Grow” tab at the bottom menu. Scroll to find the “Ziidi” icon (it looks like a money growth symbol) and tap it.

- USSD Method: Dial *334# on your phone. Select “Lipa na M-PESA” > “Buy Goods and Services” or directly navigate to investment options. Ziidi is under the wealth/investment menu (option 5 for Ziidi in some updates).

You’ll see a welcome screen with details on yields (e.g., 6.84% as of early September 2025—check daily as it fluctuates with market rates).

Step 3: Register and Opt-In

- If you’re new to Ziidi, select “Sign Up” or “Join Ziidi.”

- Read and accept the terms and conditions (outlines risks, like no guaranteed returns, and your rights as per CMA rules).

- Enter your M-Pesa PIN to confirm.

- You’ll receive an SMS confirmation from Safaricom (e.g., “Welcome to Ziidi MMF. Your account is active.”). This takes under a minute no paperwork or ID uploads needed.

Note: Ziidi is for individuals only right now; chamas and businesses may be added later. If you’re under 18, parental consent might be required via Safaricom support.

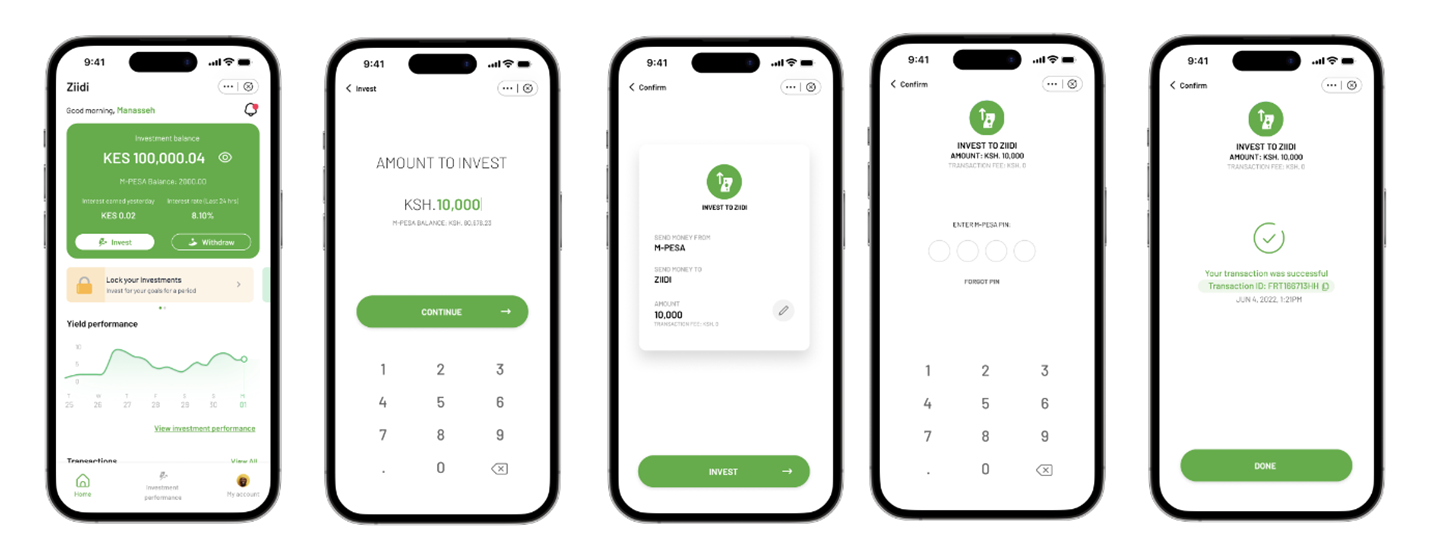

Step 4: Make Your First Investment (Deposit)

- From the Ziidi dashboard (in the app or *334# menu), select “Invest” or “Deposit.”

- Enter the amount (minimum KSh 100; e.g., KSh 1,000 to start).

- Confirm the amount and enter your M-Pesa PIN.

- Funds transfer instantly from your M-Pesa wallet to your Ziidi account. You’ll get an SMS: “KSh [amount] deposited to Ziidi MMF. Expected daily interest: [approx. amount].”

Your money is now invested in short-term securities like Treasury bills, earning daily interest. Track it on the dashboard under “Investment Performance.”

Example: Invest KSh 10,500 at 6.84% yield? Expect ~KSh 2 daily interest (~KSh 60 monthly, pre-tax).

Step 5: Monitor, Add More, or Withdraw

- Track Earnings: View balance, daily yield, and projected returns in the app’s Ziidi section or *334#. Interest accrues daily and compounds.

- Add Funds: Repeat Step 4 anytime, with no limits beyond M-Pesa caps. Set up recurring deposits via standing orders in the app for hands-off growth.

- Withdraw: Select “Withdraw” > Enter amount (min. KSh 10) > PIN > Funds hit your M-Pesa instantly. No penalties!

- Lock Funds (Optional): For discipline, lock portions to prevent impulse withdrawals (via app/USSD). Locked funds still earn interest.

Common FAQs

- What if I forget my PIN? Reset via Safaricom customer care (dial 100 for prepaid).

- Is it safe? Yes, protected by M-Pesa security and CMA oversight. Principal is low-risk, but returns aren’t guaranteed.

- Taxes? 15% withholding tax on interest, deducted automatically.

- Shariah Option? A compliant version launched in early 2025; check the app for eligibility.

- Support: Dial 100/200, or visit a Safaricom shop.

Why Ziidi in 2025?

With competitive yields (6-7% amid stabilising CBK rates) and instant liquidity, Ziidi beats basic savings accounts.

It’s grown massively since launch, hitting KSh 6B+ AUM by mid-2025. Start small; stay consistent. Compound interest is your friend!

Ready? Grab your phone and invest today. This isn’t financial advice consult a pro for your situation. Data current as of September 30, 2025; yields change daily, so verify in-app. Happy investing!

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, climate change, and digital finance at Africa Digest News.

Leave a Reply