In Kenya’s ever-evolving financial landscape, the choice between SACCO loans and bank loans isn’t always clear-cut. Whether you’re a salary earner looking to build a home or an SME owner looking for working capital, understanding the key differences can save you money, time, and stress.

This guide breaks down the debate, SACCO loans vs bank loans Kenya,with real-life comparisons, rates, and insights for 2025 and beyond.

Why It Matters

SACCOs (Savings and Credit Cooperative Organisations) have become a go-to for many Kenyans, especially those seeking affordable loans for SMEs and salary-based lending. But banks are also evolving, offering faster digital processing and flexible loan products. So how do you choose?

1. Interest Rates: SACCOs Often Win

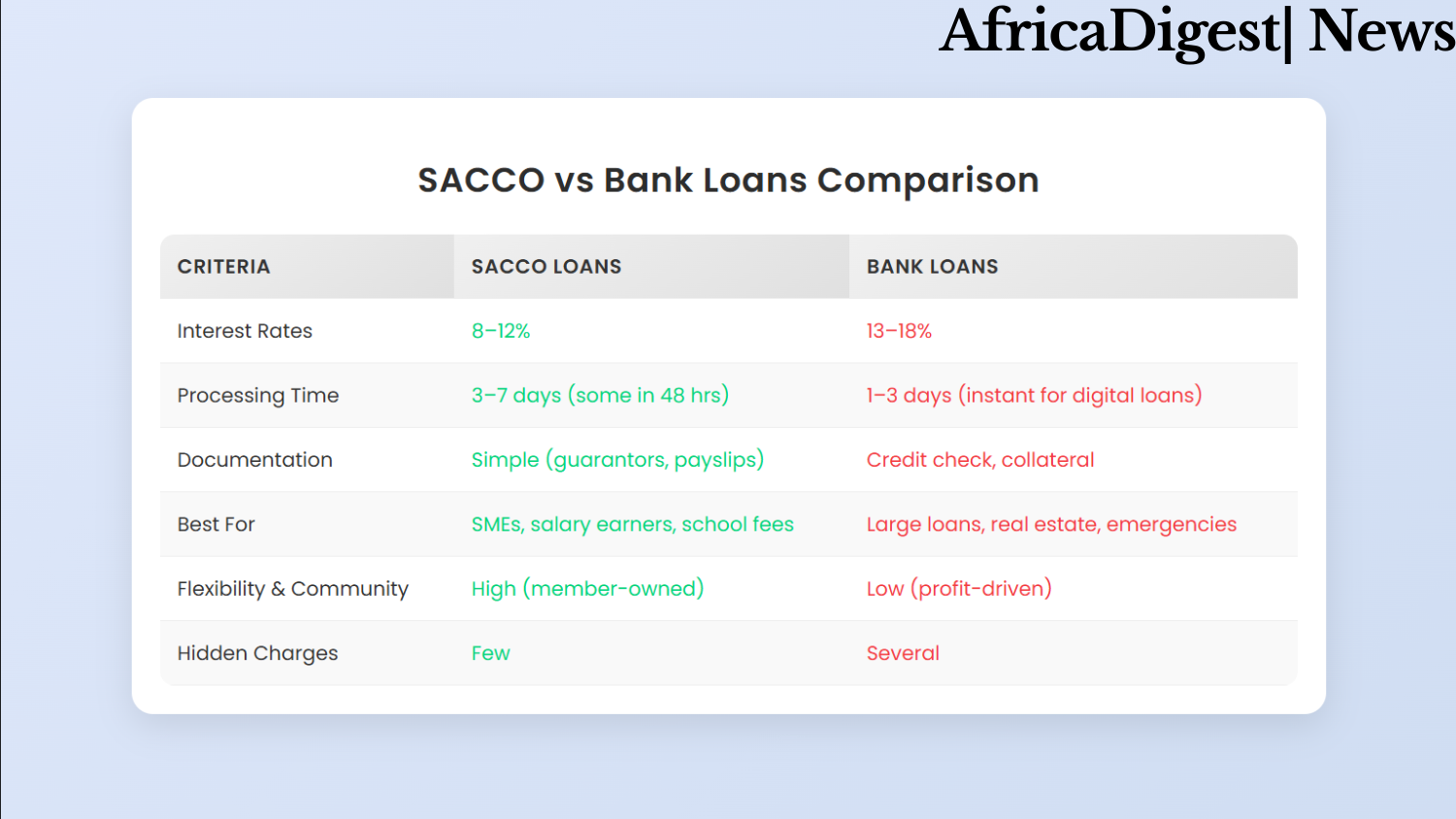

One of the biggest advantages of SACCOs is their lower interest rates. The average SACCO loan interest rates in Kenya range between 8% to 12% per annum on a reducing balance, significantly lower than bank loan interest rates in Kenya, which can climb above 13% to 16% or more, especially for unsecured personal or SME loans.

Real Example: Mercy, a primary school teacher in Kiambu, took a Ksh 500,000 SACCO loan at 10% interest and repaid it over 36 months. Her colleague opted for a bank loan at 15%, and paid over Ksh 60,000 more in interest.

2. Processing Time: Banks are Faster, but SACCOs are Catching Up

Bank loans are often favoured for emergencies because of faster digital processing. Many apps offer disbursement within 24–72 hours. SACCOs traditionally take 3–7 working days, but new fintech-driven SACCOs now offer fast SACCO loans Kenya, even within 48 hours for pre-qualified members.

READ ALSO:

How to Join a SACCO in Kenya and Start Saving: The Ultimate Guide for 2025

3. Accessibility & Flexibility

SACCO loans for salary earners are more flexible with documentation. You typically need:

- Payslips

- Guarantors (from the same SACCO)

- Membership (usually 6 months savings)

Banks, on the other hand, may require:

- Higher minimum income

- Strong credit scores

- Collateral (for business loans)

Which is better SACCO or bank loan? For regular income earners, SACCOs may be more lenient and community-driven.

4. Loan Purpose: Best Fit for Your Needs

- SACCO loans for SMEs with low interest are ideal for startup capital, stock purchases, or expanding a shop.

- Banks are better suited for large-scale financing, asset financing, and real estate due to larger capital bases.

5. Hidden Fees and Penalties

Many borrowers overlook this. Bank loan hidden fees in Kenya can include:

- Processing fees (1–3%)

- Insurance

- Early repayment penalties

SACCOs, by contrast, are more transparent; most fees are declared upfront.

6. Repayment Terms

- SACCOs typically offer longer repayment periods of up to 60 months with lower monthly deductions.

- Banks may offer shorter tenures unless the loan is secured.

READ ALSO:

How SACCO Dividends Work: A Guide to Growing Your Savings in Kenya

Final Verdict: Which Loan Is Right for You?

If you’re a salary earner or run a small business, SACCO loans in Kenya might offer better value, lower interest, and more flexibility. However, if you need instant cash, or higher limits without guarantors, banks could be the answer, at a higher cost.

For 2025, the gap between the two is narrowing. New digital SACCOs and cooperative fintechs now offer fast SACCO loans Kenya with improved processing and fewer barriers.

Still undecided? Start by comparing your SACCO loan requirements in Kenya against your nearest bank. Choose what fits your goals,not just your urgency.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, and digital finance at Africa Digest News.

Leave a Reply