Savings and Credit Cooperative Organisations (SACCOs) are a cornerstone of Kenya’s financial landscape, empowering millions with affordable loans, competitive savings rates, and dividends.

Regulated by the Sacco Societies Regulatory Authority (SASRA), SACCOs cater to diverse groups like teachers, police, civil servants, and entrepreneurs, offering tailored financial solutions.

In 2025, the best SACCOs stand out for their financial stability, innovative digital platforms, and member-centric services. Whether you’re a teacher, nurse, or small business owner, these SACCOs can help you achieve your financial goals.

Why Choose a SACCO in Kenya?

SACCOs offer unique advantages over traditional banks:

- Affordable Loans: Lower interest rates, often 1% per month on a reducing balance.

- High Dividends: Members earn returns on savings and shares, e.g., up to 15% annually.

- Financial Inclusion: Accessible to professionals and informal sector workers.

- Digital Innovation: Mobile apps and USSD platforms for convenient banking.

- Community Focus: Member-owned models prioritise welfare and collective growth.

With over 6 million members and KSh 1.2 trillion in assets, according to a 2025 report by SASRA, SACCOs are trusted for savings and loans.

Below are the top 10 SACCOs in Kenya for 2025, selected based on financial performance, member satisfaction, and service diversity.

Top 10 SACCOs in Kenya for Savings and Loans

1. Stima SACCO

Established in 1974, Stima SACCO serves energy sector employees and the public, with over 40,000 members and KSh 30 billion in assets. It’s renowned for low-interest loans and innovative digital platforms like M-Pawa.

Standout Features:

- Loans up to 3 times savings at 1% monthly interest (reducing balance).

- M-Pawa app for instant loans and mobile banking.

- 15% dividend payout in 2023, among the highest in Kenya.

- Five branches (Nairobi, Mombasa, Kisumu, Eldoret, Olkaria).

Best For: Professionals seeking fast loans and tech-savvy banking.

2. Mwalimu National SACCO

Founded in 1974, Mwalimu serves over 80,000 teachers with KSh 64.06 billion in assets. It’s Africa’s largest SACCO, known for high dividends and teacher-focused welfare programmes.

Standout Features:

- Loans up to 3.5 times savings, repayable over 72 months.

- 12% dividend payout in 2023; 25% by some SACCOs like 2NK in 2023.

- Mobile banking app and 18 branches (e.g., Nairobi, Kisumu, Mombasa).

- Education and emergency loans tailored for teachers.

Best For: Teachers and educators seeking high returns and long-term loans.

3. Kenya Police SACCO

Established in 1972, this SACCO serves police officers and the public, with 73,000 members and KSh 54.24 billion in assets. It won “Best Managed SACCO” at the 2024 Ushirika Gala Awards.

Standout Features:

- Low-interest emergency and housing loans (1% monthly).

- M-Tawi app for seamless transactions.

- 11% savings interest rate annually.

- Robust welfare programmes, including insurance for police officers.

Best For: Law enforcement and those prioritising welfare benefits.

4. Unaitas SACCO

Started in 1993 as Muramati SACCO, Unaitas now has over 200,000 members and 31 branches. It’s ideal for SMEs and small-scale investors with KSh 10 billion in assets.

Standout Features:

- Loans up to 3 times savings at 1% monthly interest.

- 10% savings interest rate annually.

- Mobile banking and USSD (*346#) for easy access.

- Financial literacy programmes for members.

Best For: Entrepreneurs and small business owners.

5. Harambee SACCO

Founded in 1970, Harambee has over 80,000 members and KSh 37.01 billion in assets. It’s known for community-driven financial solutions and a strong asset base.

Standout Features:

- Loans up to 3 times savings, repayable over 48 months.

- 10.3% savings interest rate annually.

- Mobile banking app and 174 branches nationwide.

- Education and housing loans for diverse members.

Best For: Kenyans seeking inclusive, community-focused SACCOs.

6. Safaricom SACCO

Catering to Safaricom employees and tech-savvy individuals, this SACCO leverages digital platforms for seamless services. It has a strong focus on innovation.

Standout Features:

- Instant loans via mobile app and USSD (*641#).

- Competitive 10% savings interest rate.

- Loans up to 3 times savings at 1% monthly.

- Digital-first approach with minimal physical branches.

Best For: Tech-savvy individuals and Safaricom employees.

READ ALSO:

What Is a SACCO and How Does It Work in Kenya?

7. Afya SACCO

Serving healthcare professionals since 1971, Afya SACCO has over 15,000 members and offers tailored financial products for medical practitioners.

Standout Features:

- Loans up to 3.5 times savings at 1% monthly interest.

- E-services like tender and dividends portals.

- 10% savings interest rate annually.

- Focus on healthcare-specific loans (e.g., equipment financing).

Best For: Nurses, doctors, and healthcare workers.

8. Mhasibu SACCO

Overview: Founded in 1986, Mhasibu serves accountants and finance professionals with KSh 7.5 billion in assets. It’s known for diverse loan products like Gold and Mobi loans.

Standout Features:

- Loans up to 3 times savings, repayable over 60 months.

- Mobile banking app and USSD (*369#).

- 10% savings interest rate annually.

- Professional development programmes for members.

Best For: Accountants and finance professionals.

9. Waumini SACCO

Established in 1974 by the Catholic Church, Waumini serves 33,000 members with a focus on short-term projects. It’s open to all, with KSh 39 billion in assets.

Standout Features:

- Loans up to 3 times savings at 12.5% annual interest.

- FOSA and BOSA savings products.

- 10% savings interest rate annually.

- Strong community ties and financial education.

Best For: Faith-based members and short-term investors.

10. Imarika SACCO

Started in 1974 in Kilifi, Imarika serves over 37,000 members, primarily TSC employees. It’s known for accessible loans and a growing presence.

Standout Features:

- Loans up to 2 times savings at 12.5% monthly interest.

- Mobile banking and USSD services.

- 10% savings interest rate annually.

- Focus on rural financial inclusion.

Best For: Teachers and rural savers.

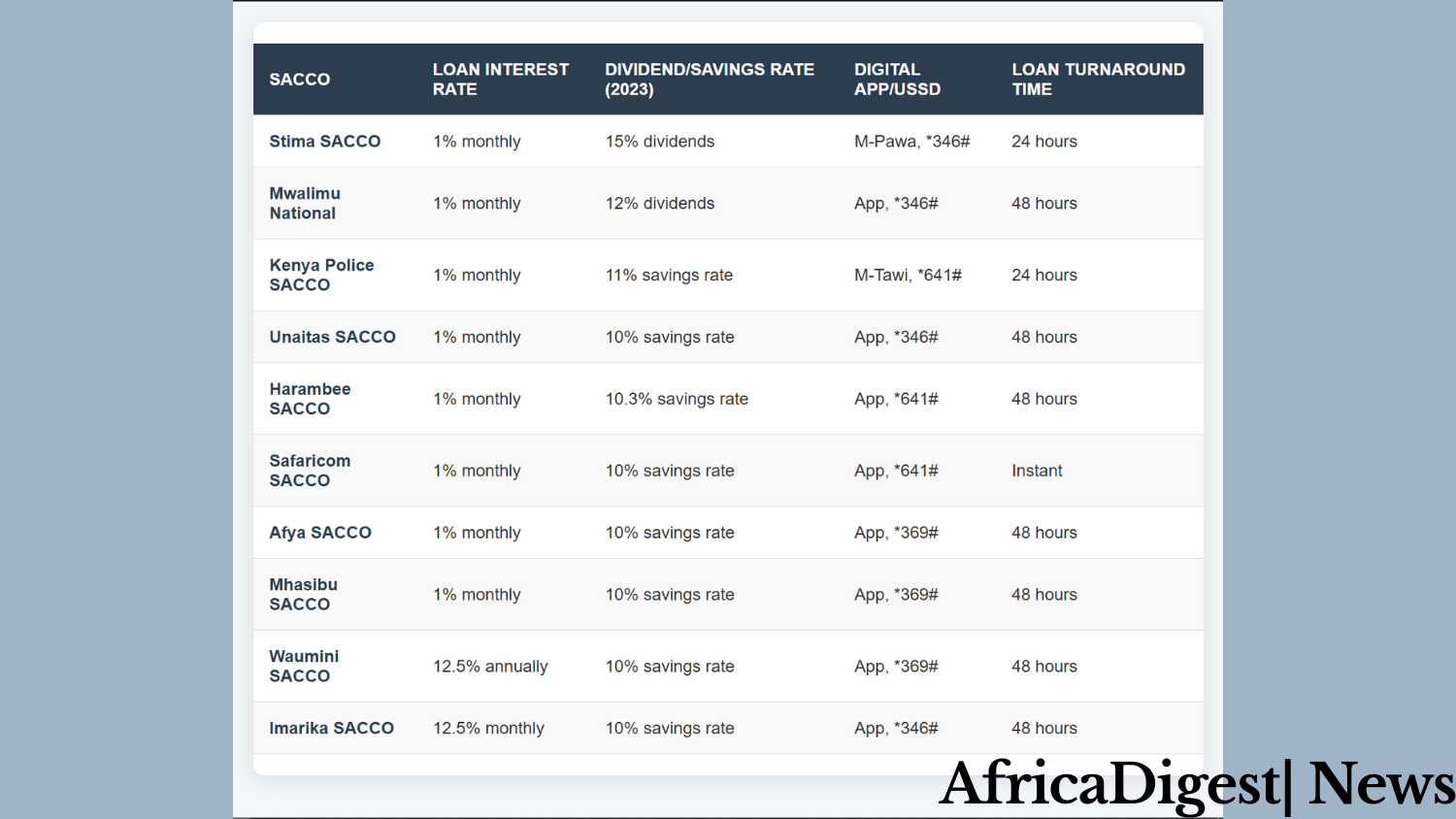

Comparison Table: Top 10 SACCOs in Kenya

Note: Rates and turnaround times are based on 2023-2024 data and may vary.

How to Choose the Best SACCO for You

- Check SASRA Registration: Ensure the SACCO is licensed by SASRA for security.

- Evaluate Loan Terms: Look for low interest rates (e.g., 1% monthly) and flexible repayment periods (up to 72 months).

- Assess Dividends: Higher dividends (e.g., Stima’s 15%) mean better returns on savings.

- Digital Access: Prioritise SACCOs with mobile apps or USSD for convenience.

- Membership Eligibility: Some SACCOs (e.g., Mwalimu, Afya) are profession-specific, while others (e.g., Unaitas, Harambee) are open to all.

- Reputation: Research member testimonials and awards (e.g., Kenya Police’s 2024 Ushirika Award).

FAQs

Q: Which SACCO offers the fastest loan approval?

A: Safaricom SACCO and Stima SACCO provide instant loans via their mobile apps.

Q: Can I join multiple SACCOs?

A: Yes, as long as you meet each SACCO’s membership criteria and can manage contributions.

Q: What’s the minimum savings requirement?

A: Most SACCOs require a minimum monthly contribution of KSh 1,000.

Q: Are SACCOs safer than banks?

A: SASRA-regulated SACCOs are safe, with audits ensuring transparency. Always verify registration.

Looking Ahead

Kenya’s top SACCOs in 2025 offer a blend of affordability, innovation, and community empowerment. From Stima SACCO’s instant loans to Mwalimu National’s high dividends, there’s a SACCO for every Kenyan, whether you’re a teacher, police officer, or entrepreneur.

Use the comparison table to evaluate options and visit SACCO websites for membership details. Join a SACCO today and take control of your financial future!

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, and digital finance at Africa Digest News.

Leave a Reply