In Kenya, where 83% of people use digital financial services (CBK, Q1 2024), managing your money is easier than ever with mobile apps.

For young professionals, hustlers, and SMEs, budgeting is critical to achieving financial goals, whether saving for a new hustle, paying off a mobile loan, or planning a big event.

Expense tracker apps like Money254 and Chumz are gaining popularity for their user-friendly features and M-Pesa integration, helping Kenyans stay on top of their finances.

In this guide, we rank the top 5 expense tracker apps in Kenya, comparing their features, costs, and availability on Android and iOS.

Plus, we share tips to link these apps to your bank or mobile money for seamless budgeting.

Why Use Expense Tracker Apps in Kenya?

With 52.79% of loans in Kenya being mobile-based (CBK, Q1 2024), tracking expenses is key to avoiding debt traps and building wealth. Expense tracker apps offer:

- Real-time insights: See where your money goes, from matatu fares to M-Pesa transactions.

- Budget alerts: Get warnings when you’re overspending on airtime or groceries.

- M-Pesa integration: Track mobile money transactions automatically, a must for Kenya’s 30M+ M-Pesa users.

- Goal setting: Save for a boda boda, wedding, or chama project with clear targets.

Whether you’re a Nairobi hustler or a diaspora Kenyan managing remittances, these apps help you take control. Below, we compare the top 5 apps based on features, user reviews, and compatibility.

Top 5 Expense Tracker Apps in Kenya

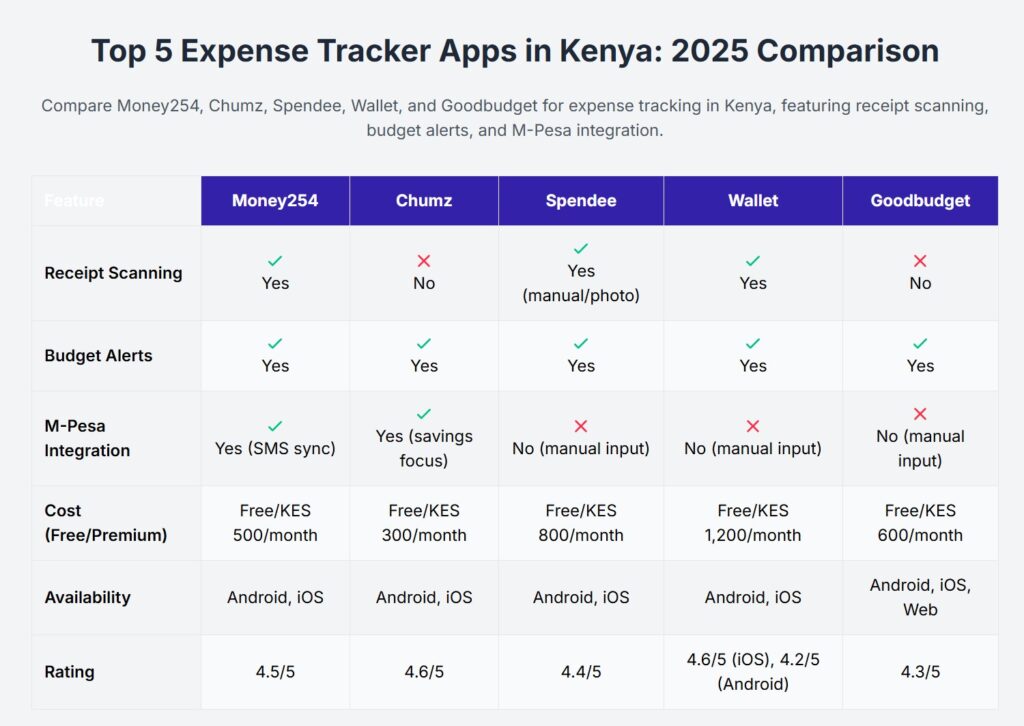

1. Money254

Why It’s Great: Money254, a Kenyan-developed app, stands out for its seamless M-Pesa integration and AI-driven insights tailored for local users. It automatically tracks expenses via mobile money SMS, ideal for hustlers managing daily transactions.

Key Features:

- Receipt Scanning: Upload receipts for instant categorisation (e.g., groceries, transport).

- Budget Alerts: Notifies you when you exceed budgets for airtime or bills.

- M-Pesa Integration: Reads transactional SMS for real-time expense tracking.

- Free Version: Basic tracking and reports; premium (KES 500/month) unlocks AI budget predictions.

User Reviews: Rated 4.5/5 on Google Play (10K+ reviews), praised for its “hustler-friendly” interface but criticised for occasional SMS sync delays.

Availability: Android, iOS.

READ ALSO:Chumz Expands Footprint to Rwanda After Kenyan Success

2. Chumz

Why It’s Great: Chumz, ranked Kenya’s best digital savings app in 2022 by the Capital Markets Authority (CMA), combines expense tracking with savings (6–8% interest). It’s perfect for chamas and youth saving as little as KES 5.

Key Features:

- Group Savings: Track chama contributions via M-Pesa, ideal for collective budgeting.

- Budget Alerts: Pop-up reminders to save before spending (e.g., after receiving M-Pesa).

- Goal Setting: Set targets like KES 10,000 for a phone, with progress tracking.

- Free Version: Full expense tracking; premium (KES 300/month) adds investment options.

User Reviews: 4.6/5 on Google Play (15K+ reviews), loved for low-entry savings, but some users want more detailed reports.

Availability: Android, iOS.

3. Spendee

Why It’s Great: Spendee’s intuitive interface and customisable categories make it a global favourite, adopted by Kenyan professionals for its infographics and multi-device sync. It’s ideal for those juggling multiple income sources.

Key Features:

- Receipt Scanning: Manual entry or photo upload for expense logging.

- Budget Alerts: Custom alerts for categories like dining or airtime.

- M-Pesa Integration: Limited; requires manual input for mobile money.

- Free Version: Basic tracking; premium (KES 800/month) unlocks auto-tracking and bank sync.

User Reviews: 4.4/5 on Google Play and App Store (50K+ reviews), praised for graphs, but premium features are pricey for some Kenyans.

Availability: Android, iOS.

4. Wallet

Why It’s Great: Wallet offers flexible budgeting and multi-currency support, perfect for diaspora Kenyans or traders dealing in USD or TZS. Its cloud sync ensures access across devices, though its iOS app has a better UI than Android.

Key Features:

- Receipt Scanning: Upload receipts or manually log transactions.

- Budget Alerts: Alerts for overspending on rent or chama contributions.

- Bank Sync: Connects to Kenyan banks like KCB or Equity (premium feature, KES 1,200/month).

- Free Version: Basic tracking and reports; premium adds bank sync and detailed analytics.

User Reviews: 4.6/5 on App Store, 4.2/5 on Google Play (100K+ reviews), with Android users noting UI lag.

Availability: Android, iOS.

5. Goodbudget

Why It’s Great: Goodbudget uses the envelope budgeting method, popular among Kenyan chamas for allocating funds to specific categories (e.g., food, transport). It’s ideal for manual trackers who don’t need bank sync.

Key Features:

- Envelope Budgeting: Allocate funds to virtual envelopes (e.g., KES 5,000 for groceries).

- Budget Alerts: Warns when envelope funds are low.

- M-Pesa Integration: Manual entry only; no auto-sync for mobile money.

- Free Version: 10 envelopes, basic reports; premium (KES 600/month) offers unlimited envelopes.

User Reviews: 4.3/5 on Google Play and App Store (20K+ reviews), praised for simplicity but lacks M-Pesa auto-tracking.

Availability: Android, iOS, Web.

Comparison Table: Top 5 Expense Tracker Apps

Tips for Linking Apps to Bank Accounts or Mobile Money

To maximize these apps’ potential, link them to your financial accounts for seamless tracking:

- Enable SMS Permissions: For Money254 and Chumz, grant SMS access to auto-track M-Pesa, Airtel Money, or T-Kash transactions. Ensure your phone’s M-Pesa app is updated for accurate SMS logs.

- Connect Bank Accounts: Wallet and Spendee (premium) sync with Kenyan banks like Equity, KCB, or NCBA via secure platforms like Plaid. Check your bank’s mobile app for API compatibility.

- Manual Entry for M-Pesa: For apps without M-Pesa integration (e.g., Goodbudget, Spendee), forward M-Pesa transaction SMS to a dedicated email or log manually daily to stay accurate.

- Secure Your Data: Use apps with 256-bit encryption (e.g., Wallet, Money254) and set PINs or fingerprints to protect financial data, especially after reports of some apps sharing data with third parties.

- Check Compatibility: Ensure your Android or iOS version supports the app (e.g., Money254 requires Android 8.0+). Update your device for optimal performance.

Pro Tip: For chamas, use Chumz’s group savings feature to track collective expenses and contributions via M-Pesa, ensuring transparency for all members.

READ ALSO:Top 5 Investment Apps for Kenyans in 2025: Stocks, Treasury Bills, and More

Why These Apps Are Important for Kenyans

Kenya’s financial landscape, with 30 million M-Pesa users and a growing digital loan market, demands tools that keep up with daily transactions.

Apps like Chumz excel due to their local focus, integrating seamlessly with M-Pesa and addressing hustlers’ needs.

Global apps like Spendee, Wallet, and Goodbudget offer robust features for professionals and diaspora users but may require manual input for mobile money.

With KES 10 billion in Hustler Fund defaults reported in 2023, budgeting apps are critical to avoid overspending and manage loans effectively.

Get Started Today

Ready to take control of your finances? Download Chumz for M-Pesa-friendly tracking, or try Spendee, Wallet, or Goodbudget for global-standard features.

Dial *254# to explore how budgeting can complement affordable loans like the Hustler Fund’s Bridge Loan.

Share your favourite app or budgeting tips in the comments below, and follow Fintech News for more ways to grow your hustle in Kenya!

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, and digital finance at Africa Digest News.

Leave a Reply