Sitoyo Lopokoiyit has announced his departure as Managing Director of M-PESA Africa, effective 31 March 2026, to assume the role of Chief Executive for Personal and Private Banking at Absa Bank Kenya, commencing 1 April 2026.

This high-profile transition, confirmed on 11 February 2026, represents one of the most significant leadership movements between Africa’s fintech and traditional banking sectors in recent years.

Mr Lopokoiyit’s five-year tenure at M-PESA Africa (since April 2021) and prior 15-year career at Safaricom have positioned him as a pivotal figure in scaling digital financial services.

His move underscores the accelerating convergence of mobile-first fintech platforms and established banking institutions across the continent.

Contributions at M-PESA Africa

Under Mr Lopokoiyit’s leadership, M-PESA Africa evolved from a core mobile-money utility into a broad digital financial ecosystem.

The platform now serves over 37 million monthly active users (with group-level figures exceeding 56 million customers and 5 million businesses across multiple markets).

Key achievements include:

- Launch and scaling of innovative products such as Fuliza (the world’s first mobile-money overdraft facility), Pochi la Biashara, the M-PESA Super App, and Ziidi Trader for direct equity access.

- Expansion into eight African markets through the Safaricom-Vodacom joint venture.

- Global partnerships with entities such as PayPal and AliPay to enhance international remittances and interoperability.

These developments elevated M-PESA to critical national infrastructure status in Kenya, where any operational disruption now carries systemic implications for financial stability and inclusion.

Strategic Impact on Absa Bank Kenya

Absa Group’s appointment of Mr Lopokoiyit aligns with its pan-African strategy to strengthen digital execution, customer-centric growth, and integrated financial services.

As Chief Executive for Personal and Private Banking across the Group, he will oversee one of Absa’s key growth engines, bringing deep expertise in scaling fintech platforms, customer value propositions, and large-scale transformation.

Kenny Fihla, Absa Group Chief Executive Officer, emphasised that the leadership, alongside concurrent changes in governance, compliance, and audit lleadership,aims to build a future-fit executive team combining internal capability with targeted external expertise.

READ ALSO:Who Is Juan Jose Dada and Why FMO Chose Him as Co-CIO

Mr Lopokoiyit’s fintech background is expected to accelerate Absa’s digital banking capabilities, enhance customer experience, and drive innovation in retail and private banking segments.

This move signals Absa’s intent to integrate mobile-first approaches and data-driven financial inclusion strategies into traditional banking operations.

Broader Implications for the African Financial Services Landscape

Mr Lopokoiyit’s transition highlights the increasing fluidity between telecommunications-led fintech and conventional banking.

His experience bridging telco ecosystems and financial services positions him uniquely to contribute to this convergence.

For M-PESA Africa, the departure introduces leadership continuity considerations at a time when the platform manages systemic scale and ongoing innovation.

The incoming Managing Director will inherit responsibility for maintaining stability, advancing product development, and sustaining growth across markets.

For Absa, the appointment reinforces a deliberate strategy to leverage fintech talent for competitive differentiation in personal and private banking, particularly in East Africa and beyond.

Looking Ahead

Sitoyo Lopokoiyit’s move from M-PESA Africa to Absa Bank Kenya reflects the evolving dynamics of Africa’s financial services sector, where expertise in digital scale and inclusion is increasingly valued across institutional boundaries.

His legacy at M-PESA will shape expectations for continuity under new leadership. At Absa, his arrival is poised to bolster digital priorities and pan-African ambitions.

This transition highlights the strategic importance of experienced leadership in bridging fintech innovation and traditional banking.

For further updates, consult official communications from Safaricom, M-PESA Africa, or Absa Group.

M-PESA Overview

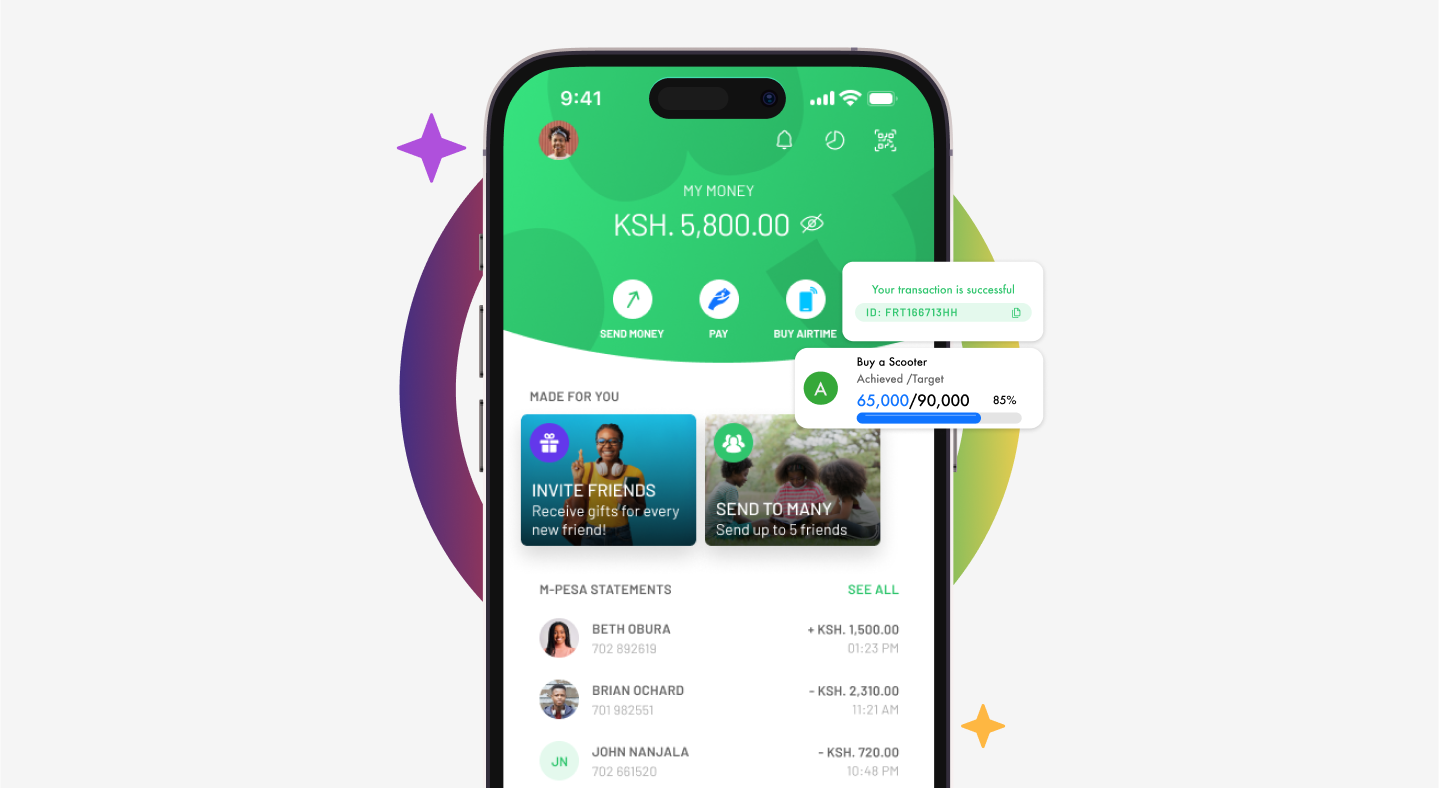

M-PESA app is Safaricom’s mobile money application that allows users to send money, pay bills, buy airtime, access loans and savings, and manage transactions directly from their smartphones.

M-PESA app download is available on Google Play Store and Apple App Store.

M-PESA Login / My M-Pesa is done using your registered Safaricom number and M-PESA PIN within the app.

M-PESA Kenya refers to the mobile money service operated by Safaricom, widely used for person-to-person transfers, business payments, and financial services across the country.

The M-PESA website (safaricom.co.ke/mpesa) provides product information, tariffs, and support resources.

M-PESA online services include web-based portals for businesses and integrations for payments, while M-PESA open now typically refers to agents currently available for deposits and withdrawals near your location.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, climate change, and digital finance at Africa Digest News.

Leave a Reply