The International Finance Corporation (IFC) is considering an investment of up to $50 million in Adenia Entrepreneurial Fund I (AEF I), a pan-African private equity fund managed by Adenia Partners.

This package comprises $30 million committed directly to the fund and a $20 million co-investment facility for select deals. The proposal is scheduled for review by IFC’s board on February 11, 2026.

International Finance Corporation (IFC) branding, representing its role in supporting private sector development in emerging markets.

AEF I targets a total commitment size of $150–180 million and plans to invest in approximately 10 growth-stage companies, with typical ticket sizes ranging from $10–20 million.

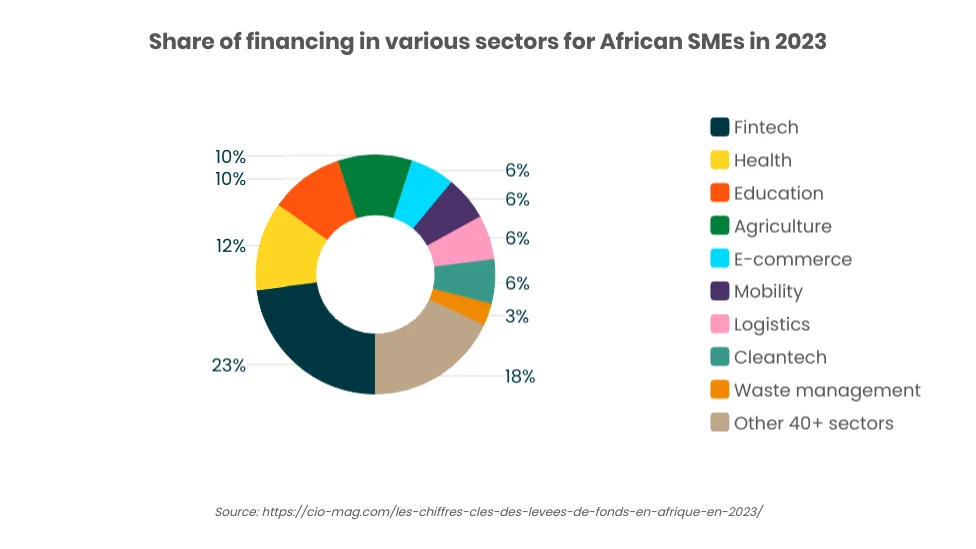

The fund focuses on founder-led small and medium-sized enterprises (SMEs) in sectors vital to Africa’s economic resilience and development.

Fund Strategy and Sector Priorities

Adenia Entrepreneurial Fund I seek to address a structural funding gap for SMEs that have outgrown microfinance but remain underserved by traditional private equity.

Investments will involve majority stakes to enable operational enhancements, governance improvements, and strategic expansion.

Adenia Partners logo and visuals, illustrating the firm’s commitment to responsible investing across Africa.

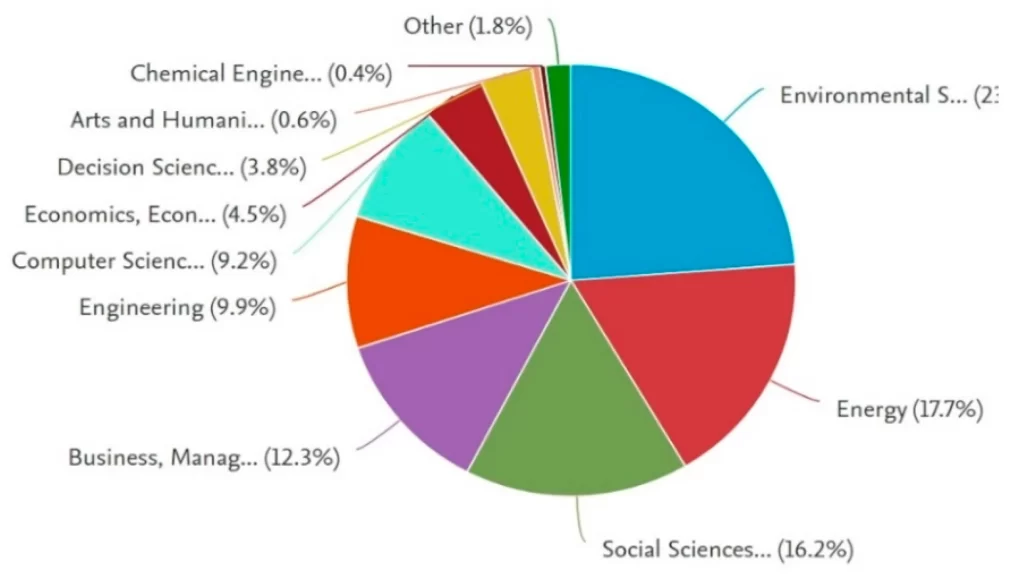

The fund prioritises sectors including light manufacturing, consumer goods and services, renewable energy, healthcare, and education.

These areas align with opportunities for scalable growth, job creation, particularly for youth and women, and alignment with the 2X Challenge gender-equality framework.

Potential Beneficiary SMEs

African SMEs in the targeted sectors stand to gain significantly from AEF I’s capital and value-creation expertise.

In light manufacturing and consumer goods, companies engaged in food processing, textiles, or distribution could benefit from investments that enhance efficiency and market reach.

Examples of African SMEs in manufacturing and consumer goods sectors, highlighting operational growth potential.

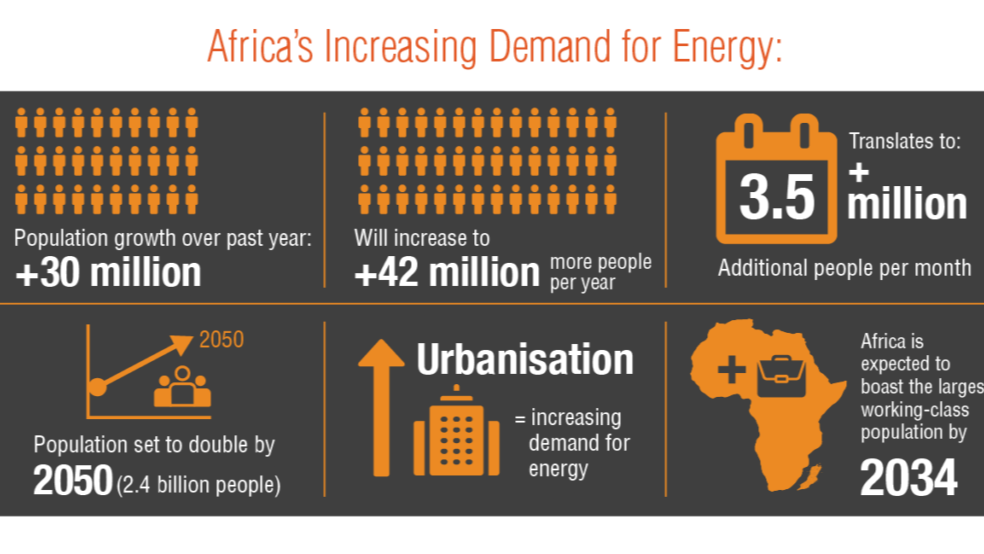

In renewable energy, firms developing off-grid solar solutions or energy-efficient technologies may access funding to scale operations and address energy access gaps.

READ ALSO:Why IFC Is Backing Summit Africa’s Second Private Equity Fund

Healthcare and education enterprises, such as private clinics, pharmaceutical distributors, or edtech providers, could leverage capital for infrastructure upgrades and service expansion.

Visuals depicting SMEs in renewable energy, healthcare, and education sectors across Africa.

These businesses, often founder-led and regionally focused, would receive hands-on support from Adenia to strengthen competitiveness, foster inclusive employment, and promote sustainable practices.

Broader Impact and Adenia’s Approach

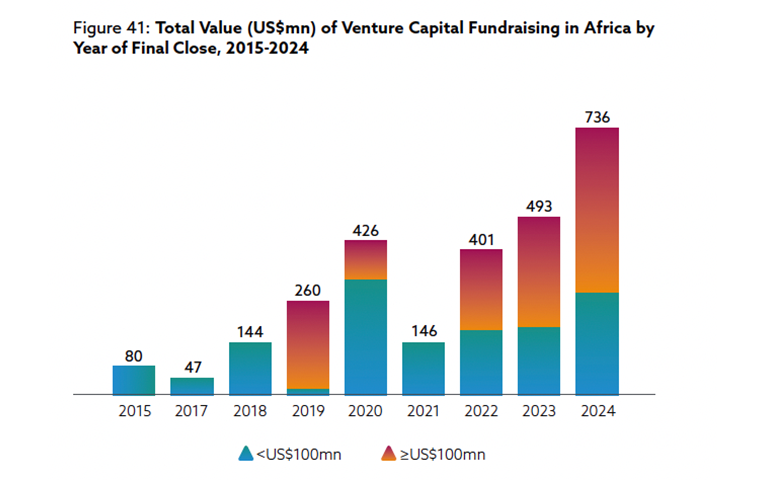

IFC’s proposed commitment underscores the critical role of SMEs in Africa’s economy, where they represent a key driver of employment and innovation yet face persistent capital constraints.

By channelling funds through Adenia Partners, an established firm with a proven track record of responsible investing and value creation, the initiative aims to deliver both financial returns and measurable development outcomes.

Graphics illustrating private equity investments and growth in African SMEs through impact-focused funds.

Adenia’s strategy emphasises ESG integration, job creation, and long-term sustainability, building on prior funds that have supported numerous African enterprises.

Looking Ahead

The proposed $50 million IFC investment in Adenia Entrepreneurial Fund I, pending board approval on February 11, 2026, offers substantial potential to benefit growth-stage African SMEs in light manufacturing, consumer goods, renewable energy, healthcare, and education.

By providing equity capital, majority ownership influence, and operational expertise, the fund can help these enterprises scale sustainably, create inclusive jobs, and contribute to economic resilience.

As of January 14, 2026, this development highlights growing institutional confidence in Africa’s SME segment. For the latest status, refer to official disclosures from IFC or Adenia Partners.

Adenia Partners Overview

Adenia Partners is a private equity firm focused on long-term investments across Africa, operating through its investment platform Adenia Capital and managing successive funds that target growth-oriented companies in key sectors.

One of its flagship vehicles, Adenia Capital V, reflects the firm’s continued commitment to supporting mid-sized businesses with patient capital, operational expertise, and a regional investment strategy aligned with sustainable value creation across the continent.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, climate change, and digital finance at Africa Digest News.

Leave a Reply