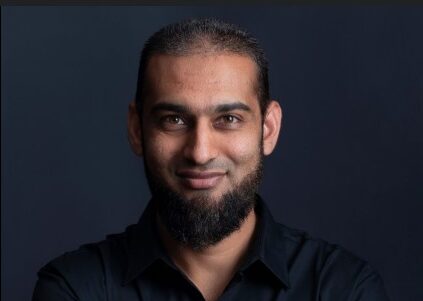

TymeBank has tapped Cheslyn Jacobs, one of its founding executives, to lead the next phase of its growth journey.

His appointment as CEO, effective January 1, 2026, follows a record-breaking year in which the bank surpassed 11 million customers. Outgoing CEO Karl Westvig will transition into an advisory role as TymeBank sharpens its focus on scale, profitability, and regional expansion.

This move marks both continuity and ambition as TymeBank prepares for rebranding, regional expansion, and a potential initial public offering (IPO).

But who exactly is Cheslyn Jacobs, and does he have what it takes to steer Africa’s fastest-growing digital bank into its next chapter?

From Industrial Psychology to Fintech Leadership

A proud South African, Cheslyn Jacobs holds a BCom in Industrial Psychology from the University of the Western Cape and a Postgraduate Diploma in Business Management from GIBS.

His early career fused consulting and banking: four years at Standard Bank building retail expertise, followed by advisory work at Deloitte in 2012, where he sharpened his strategy toolkit.

Those experiences grounded in people, process, and performance would become the foundation for a career that blends operational execution with commercial innovation.

A 13-Year Journey Inside Tyme

Jacobs joined Tyme in 2012, long before its public launch, first as Sales & Distribution Manager, later as National Operations Manager.

He helped design the retail-kiosk model that remains central to TymeBank’s low-cost distribution strategy through Pick n Pay and Boxer stores.

When TymeBank officially launched in 2019, Jacobs was appointed Head of Sales and Services, driving nationwide customer acquisition.

By 2022, he rose to Chief Commercial Officer (CCO), a pivotal role that saw TymeBank leap from startup to scale-up, surpassing 10 million users by late 2025.

Under his leadership, TymeBank expanded partnerships, deepened SME lending via Retail Capital, and strengthened its position as South Africa’s most accessible, fee-free bank.

“Cheslyn’s deep understanding of our customers, strategy, and people uniquely positions him to lead TymeBank into its next era,” said Chairman Thabani Jali, announcing the appointment.

Westvig’s Legacy and a Smooth Transition

Outgoing CEO Karl Westvig, who took the helm in 2018, guided TymeBank through rapid growth and turbulence alike, from the COVID-19 pandemic to a R1.5 billion valuation led by billionaire Patrice Motsepe.

He oversaw expansion into personal loans and insurance and spearheaded the integration of Retail Capital.

Westvig will stay on through Q1 2026 to ensure a seamless handover. His steady leadership set the stage; Jacobs’ task is to scale and diversify it.

READ ALSO:Tyme Bank Achieves $1.5B Valuation with $250M Investment Led by Nubank

The Road Ahead: IPO, Expansion, and Competition

TymeBank’s next phase centres on regional growth, new product verticals, and profitability. With a valuation topping $1.5 billion, an IPO could be within sight.

Jacobs’ commercial track record and people-first psychology background give him a dual advantage, including customer empathy and strategic rigour.

Challenges await: competition from Capitec, Discovery Bank, and mobile-first challengers, plus regulatory headwinds. Yet TymeBank’s blend of trust, accessibility, and data-driven innovation remains hard to replicate.

Analysts say Jacobs’ internal rise ensures cultural alignment and operational continuity, key for sustaining momentum as TymeBank rebrands and refines its business model for scale.

“The future of banking is inclusive, digital, and deeply human,” Jacobs noted during the announcement.

A Defining Moment for South African Fintech

Cheslyn Jacobs’ elevation is a signal of homegrown succession in a maturing fintech ecosystem. As TymeBank pursues financial inclusion across Africa, Jacobs’ blend of commercial acumen and grassroots insight may be exactly what the institution needs to transition from disruptor to dominant force.

2026 could be TymeBank’s breakout year.

TymeBank: Simplifying Digital Banking and Investments in South Africa

TymeBank continues to redefine financial inclusion through innovative digital services that make banking faster and more accessible.

Customers can easily manage their TymeBank account via the TymeBank login portal or the TymeBank Internet banking platform, which also supports TymeBank login without OTP for secure device users.

Opening a new TymeBank account is instant through the TymeBank open account feature, allowing users to start saving or explore TymeBank investment options with ease.

For security, users can manage their TymeBank login PIN directly within the app, while assistance is available through the official TymeBank WhatsApp number for quick customer support.

With its fully digital model, TymeBank continues to empower South Africans with seamless, branchless banking solutions.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, climate change, and digital finance at Africa Digest News.

Leave a Reply