Triodos Investment Management has provided a USD 5 million loan to ASA Microfinance Tanzania Limited (ASA Tanzania) through its Triodos Microfinance Fund and Triodos Fair Share Fund.

This financing, announced in early February 2026, enables ASA Tanzania to expand its lending activities and deepen outreach to low-income entrepreneurs, with a strong emphasis on women.

ASA Tanzania, a wholly owned subsidiary of ASA International Group, began operations in 2014 and has established itself as a leading microfinance provider in the country.

As of June 2025, the institution served more than 300,000 active borrowers through over 200 branches, with 97% of clients being women.

The organisation employs an efficient group lending approach that balances individual accountability with social support mechanisms to promote financial discipline and business growth.

Core Loan Products and Client Protection Measures

ASA Tanzania offers two primary loan products tailored to different segments:

- Small group loans targeted primarily at women, ranging from approximately USD 500 to USD 1,000, designed to support micro-entrepreneurs in starting or expanding small businesses.

- Small enterprise loans are available to both men and women, ranging from approximately USD 600 to USD 5,000, aimed at more established ventures requiring larger working capital.

Loan approvals are based on thorough business assessments and regular group meetings, which promote peer support and collective responsibility without joint liability.

To safeguard clients, ASA Tanzania implements measures to prevent over-indebtedness, provides insurance coverage, and conducts financial literacy training and workshops.

The institution adheres to responsible pricing standards and the SMART Campaign’s Client Protection Principles, ensuring ethical and sustainable service delivery.

Role of the USD 5 Million Financing in Expansion

The new facility will directly support the scaling of ASA Tanzania’s lending portfolio, enabling the institution to reach more underserved entrepreneurs and strengthen its presence in existing and new operational areas.

This investment aligns with ASA Tanzania’s ongoing digital transformation efforts, including preparations to introduce digital financial services that will enhance accessibility, efficiency, and client experience.

READ ALSO:Why Rafiki’s Record Revenue Signals a Turning Point in Global B2B Payments

By channelling additional capital through a proven microfinance provider, Triodos reinforces its commitment to financial inclusion in emerging markets, particularly where women face disproportionate barriers to formal credit.

Why DFIs Continue to Back Group Lending Models

Development finance institutions (DFIs) and impact investors such as Triodos maintain strong support for group lending models due to their proven effectiveness in low-income contexts.

These models leverage social collateral, including peer monitoring and mutual accountability, rather than traditional physical collateral, which is often unavailable to micro-entrepreneurs.

In Tanzania and similar markets, group lending has demonstrated high repayment rates, low default levels, and positive social outcomes, including enhanced financial discipline, business skill development, and empowerment of women.

The approach also facilitates cost-efficient outreach at scale, making it suitable for institutions serving large numbers of clients with limited resources.

Triodos’ continued investment in ASA Tanzania reflects confidence in the model’s sustainability and impact, particularly its focus on female borrowers who reinvest earnings into family welfare, education, and community development.

Looking Ahead

Triodos Investment Management’s USD 5 million loan to ASA Tanzania exemplifies a targeted approach to scaling women-focused microfinance in emerging markets.

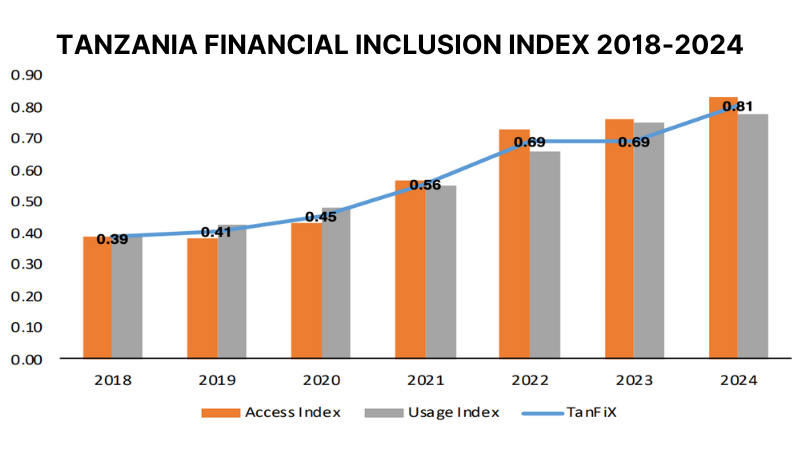

By supporting a well-established institution with a robust group lending framework, responsible practices, and digital ambitions, the financing advances financial inclusion, economic empowerment, and poverty reduction in Tanzania.

As of February 6, 2026, this transaction reinforces the enduring value of proven microfinance models in delivering measurable social and economic benefits.

For the most current details, refer to official announcements from Triodos Investment Management and ASA Tanzania.

ASA Microfinance

ASA Microfinance offers Asa microfinance loans to individuals and small businesses with specific Asa microfinance loan requirements such as proof of identity, business records or income verification depending on the product.

Customers can inquire or apply by reaching the Asa microfinance contact number provided at local branches, and the network of ASA microfinance branches across regions typically serves walk-in and registered clients.

The Asa microfinance Head Office coordinates operations, policies and product rollout, and the organisation is part of ASA International, a global microfinance group that supports financial inclusion in multiple countries.

Loan Officer at ASA microfinance professionals assist clients with applications, eligibility checks and disbursements, and many centres also support ASA loan online apply options through digital forms or referral links to streamline the process.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, climate change, and digital finance at Africa Digest News.

Leave a Reply