Norfund has announced that Chief Executive Officer Tellef Thorleifsson will step down in July 2026 after serving in the role for seven and a half years.

The announcement, made on January 19, 2026, follows Thorleifsson informing the Board of Directors of his decision to pursue a leadership transition.

He will remain in office until the handover is complete, ensuring continuity during the process.

Thorleifsson joined Norfund in autumn 2018, succeeding a period of steady growth. His departure comes at a time when the institution stands in a strong position, with a doubled portfolio, significantly increased investment pace, and expanded mandates focused on sustainable development and climate action.

Achievements During Thorleifsson’s Tenure

Under Thorleifsson’s leadership, Norfund has achieved substantial scale and impact. The fund’s invested capital has more than doubled, reaching approximately NOK 45.5 billion by the end of 2025, while annual investment volumes have nearly tripled.

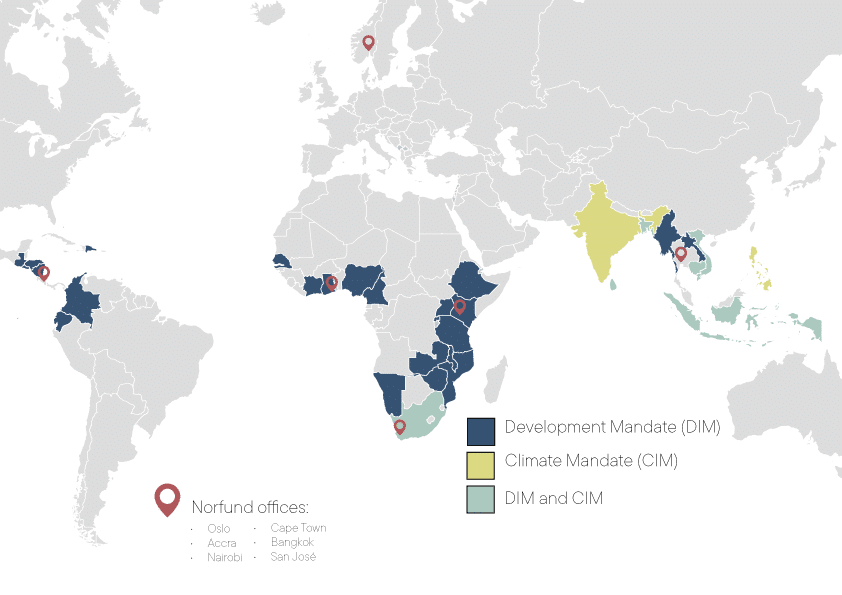

This growth has supported the creation of sustainable jobs and contributed to poverty reduction across Africa, Asia, and Latin America.

The Norwegian government entrusted Norfund with two major new mandates during this period, including the Climate Investment Fund, which has become a cornerstone of Norway’s international contribution to the global energy transition.

These assignments have positioned Norfund as a key player in mobilising private capital for climate mitigation and adaptation in developing countries.

Thorleifsson has professionalised the organisation and ensured it delivers effectively on its core mandates. His efforts have been instrumental in creating sustainable jobs that lift millions out of poverty while avoiding significant greenhouse gas emissions.

Olaug Svarva, Chair of the Norfund Board

Thorleifsson himself reflected: “I have great confidence in what we do at Norfund, and I am proud of the results we deliver through profitable investments. At the same time, I believe this is a good moment to carry out a leadership transition.”

Reasons for the Transition and Next Steps

Thorleifsson described the decision as difficult, noting his deep commitment to Norfund’s mandate, the organisation’s people, and the ongoing work.

He emphasised that the institution is well-prepared for a new strategy period, making this an appropriate juncture for fresh leadership to guide future priorities.

READ ALSO:How Mulilo Plans to Use Norfund’s Capital to Unlock a 30 GW Clean Energy Pipeline

The Norfund Board has commenced the search for a successor, aiming to identify a leader capable of building on the established foundation in frontier markets while navigating evolving global challenges in development finance and climate action.

Broader Context for Norfund’s Future

Norfund invests in commercially viable projects that promote job creation, economic development, and climate resilience in emerging and frontier markets.

The incoming CEO will inherit a diversified, resilient portfolio and a market-ready organisation equipped to address persistent financing gaps in sustainable infrastructure and enterprise.

The transition occurs amid continued global demand for blended finance and climate-focused investments, where Norfund’s experience positions it to maintain influence and deliver impact.

Looking Ahead

Tellef Thorleifsson’s planned departure in July 2026 concludes a highly successful tenure marked by substantial portfolio expansion, accelerated investment activity, and the integration of critical climate mandates at Norfund.

His leadership has strengthened the institution’s capacity to generate profitable, impactful investments in developing countries.

As the Board proceeds with the succession process, Norfund remains well-positioned to advance its mission of sustainable development and climate finance.

As of February 2, 2026, this transition reflects thoughtful planning and confidence in the organisation’s future trajectory.

For ongoing updates, refer to official communications from Norfund.

Norfund Overview

Norfund is Norway’s official development finance institution, fully owned by the Norwegian Government, making it the sole Norfund shareholder.

Through the Norfund Climate Investment Fund, it invests public capital into renewable energy and climate-mitigation projects in emerging markets.

KLP Norfund Investments AS is a joint venture between Norfund and KLP that channels long-term capital into sustainable infrastructure and energy.

Norfund ESG principles are embedded across its investments, ensuring strong environmental, social and governance standards in line with Norway’s broader Norwegian development fund objectives.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, climate change, and digital finance at Africa Digest News.

Leave a Reply