Paystack has acquired Ladder Microfinance Bank, rebranding it as Paystack Microfinance Bank (Paystack MFB).

Announced on January 14, 2026, this strategic acquisition marks the Stripe-owned Nigerian fintech’s formal entry into regulated banking, expanding beyond its core payments infrastructure after a decade of operations.

The move enables Paystack to offer lending products, hold deposits, and provide banking-as-a-service (BaaS), leveraging transactional data for enhanced credit assessment and addressing Nigeria’s significant small business financing challenges.

This development positions Paystack as a more comprehensive financial services provider, operating Paystack MFB as a separate regulated entity with its own licence, governance, and roadmap, while collaborating closely with the payments business.

Expanded Product Offerings and Vertical Integration

The acquisition allows Paystack to integrate banking services directly into its ecosystem. Paystack MFB will initially focus on business-oriented products, including working capital loans for immediate operational needs, merchant cash advances repaid from future sales, overdrafts, term loans, and BaaS solutions for companies developing financial tools.

This infrastructure-first approach comprising building from payments and layering banking on top creates a fuller financial stack for merchants.

By owning a microfinance licence, Paystack gains control over liquidity, deposits, and compliance, reducing reliance on partner banks and enabling tailored services that support business growth.

Amandine Lobelle, Chief Operating Officer at Paystack, explained: “After 10 years of building payment infrastructure and going deep, we realised that businesses needed more than just getting paid to grow. We wanted to leverage the expertise we have built over the last decade to continue to address some of the pain points that businesses have.”

Data-Driven Credit Assessment and Faster Lending

A key advantage lies in Paystack’s access to real-time transactional data from its payment network, which processes trillions of naira monthly for over 300,000 businesses.

This data enables precise credit risk evaluation based on live cash flows rather than static financial statements, leading to faster approvals, lower default risks, and more accurate lending decisions.

This capability addresses Nigeria’s estimated $32 billion small business financing gap by offering quicker, more accessible credit through formal channels.

New Revenue Streams and Competitive Positioning

Owning a bank diversifies Paystack’s revenue beyond transaction fees, introducing higher-margin lending and deposit-based products.

The structure maintains separation from the payments arm, ensuring regulatory compliance while fostering innovation in financial services.

Paystack MFB now competes with traditional microfinance institutions and digital lenders such as Carbon, Fairmoney, Moniepoint, OPay, PalmPay, and Kuda, strengthening its position in Nigeria’s converging fintech landscape.

Amandine Lobelle,Paystack COO

READ ALSO:What You Need to Know About Paystack’s First Consumer Product Launch

Contributions to Financial Inclusion and Economic Growth

By bridging payments and banking, Paystack promotes greater financial inclusion for small and medium-sized enterprises, encouraging formal financial participation and supporting economic stability. The phased rollout starting with business lending and planning consumer expansion aligns with broader efforts to deepen access to credit and services in Nigeria.

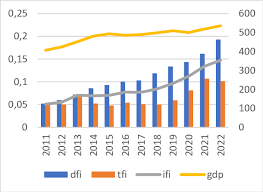

Financial Inclusion Index and Real GDP in Nigeria

The acquisition of Ladder Microfinance Bank represents a pivotal evolution in Paystack’s trajectory, transforming it from a leading payments provider into a full-stack financial services entity.

As of January 15, 2026, this step enhances control over funds, unlocks data-driven lending, generates new revenue opportunities, and advances financial inclusion for Nigerian businesses.

Such strategic moves emphasize the potential for fintech innovation to reshape economic landscapes in emerging markets. For the most current details, refer to official announcements from Paystack.

Paystack Overview

Paystack business solutions are widely adopted by merchants who want reliable online payments, and questions such as Is Paystack legit are commonly addressed by its strong regulatory compliance and market reputation.

Developers integrate the platform using multiple technologies, including Paystack golang, Paystack nodejs, and Django paystack, while educational resources like Paystack moodle content and Paystack youtube tutorials help teams understand implementation and best practices.

For businesses evaluating costs, Paystack fees remain a key consideration when choosing the platform for scalable digital payments.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, climate change, and digital finance at Africa Digest News.

Leave a Reply