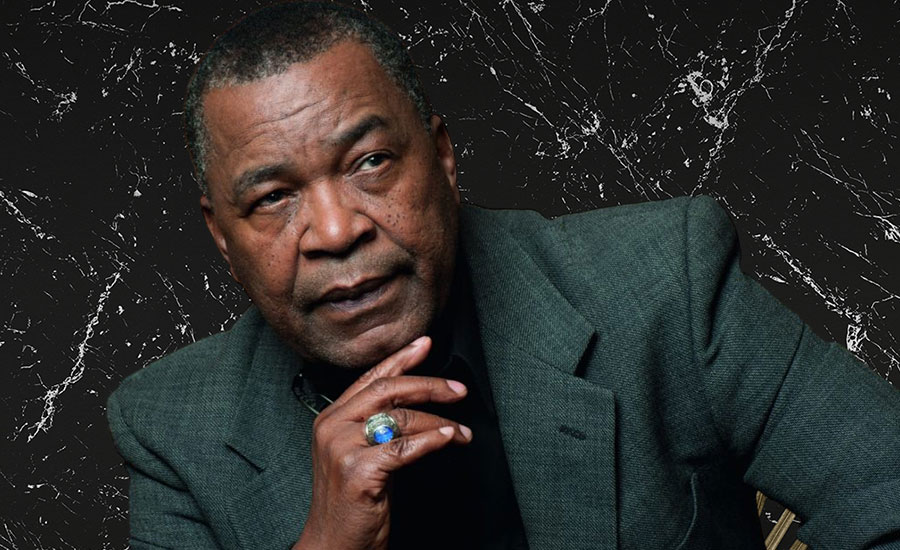

Revolut has made its most consequential move yet in Africa with the announcement of the appointment of Dr. Gaby Magomola as the inaugural Chairman of Revolut South Africa.

The timing is deliberate: the announcement came the same day Revolut submitted its Section 12 application for a full commercial banking licence with the South African Reserve Bank (SARB).

This is a calculated strategic decision that blends global fintech firepower with one of South Africa’s most seasoned banking minds.

If Revolut is to break into one of Africa’s most complex, regulated, and opportunity-rich financial markets, Dr. Magomola may be the decisive advantage.

A Veteran of Banking Turnarounds and Economic Inclusion

Few executives in South African finance carry the breadth and depth of experience that Dr. Gaby Magomola does.

Across more than 40 years in banking, his career has been defined by stabilising institutions, driving reforms, and expanding financial access.

At African Bank, he led one of the country’s most important post-apartheid turnarounds, steering the institution back toward stability during an era of economic turbulence.

His earlier roles at Citibank, Barclays, and FNB shaped his expertise in governance, risk management, and international finance.

Beyond the private sector, his work as Deputy Chairman of the Development Bank of Southern Africa (DBSA) positioned him at the intersection of infrastructure development, policy, and inclusive growth.

That blend of corporate and developmental experience is exactly what Revolut needs as it tries to embed global fintech DNA into a uniquely South African context.

Revolut doesn’t simply need a chairman but someone who can decode the regulatory environment, build trust with policymakers, and design products that resonate far beyond affluent urban centres. Dr. Magomola is uniquely equipped to do exactly that.

Navigating South Africa’s Regulatory Challenge

Revolut’s Section 12 application marks the first step toward obtaining a full commercial banking licence under the Banks Act, something few digital banks have achieved in South Africa.

SARB’s licensing regime is among the toughest in the world, emphasising consumer protection, systemic risk management, and governance integrity.

Approval can take 12–18 months, and it demands:

- Strong capital commitments

- Localised governance

- Risk frameworks tailored for South African realities

- Demonstrated commitment to financial inclusion

- Robust AML and fraud-prevention systems

This is where Dr. Magomola becomes integral. His intimate knowledge of SARB processes and his deep credibility across the financial sector will help Revolut navigate details foreign executives often underestimate.

Revolut South Africa CEO Jacques Meyer underscored this point:

“Dr. Magomola’s experience is invaluable as we deepen our commitment to the South African market. His strategic counsel will be critical in navigating the regulatory environment and building a locally relevant service.”

Dr. Magomola assumes the role in January 2026, giving Revolut time to align its licence strategy with SARB’s expectations.

The Market Opportunity: Millions Unbanked, Millions Digital

South Africa is a duality in global banking:

- 91% of adults have some form of financial access.

- Yet 4 million people remain unbanked.

- Mobile penetration exceeds 95%.

- Youth and digital natives dominate payment and fintech adoption.

- The informal economy is worth R1.8 trillion.

This is fertile ground for a sophisticated, app-first banking model if executed correctly.

Revolut’s ambitions include:

- Instant international remittances for the 2.5 million South Africans abroad

- Low-fee digital accounts for unbanked and underserved communities

- Microloans and AI-driven credit scoring for informal business owners

- Crypto access and multi-currency wallets, appealing to tech-forward youth

- Transparent, low-cost FX, a major pain point in South Africa

Dr. Magomola’s lifelong work on inclusion gives Revolut credibility as it pushes into communities traditional banks often overlook.

The Perfect Pairing

Revolut enters South Africa with enormous global momentum:

- 65 million customers

- £3.1 billion ($4B) in 2024 revenue

- £1.1 billion ($1.4B) in pre-tax profit

- A global valuation of $75 billion

- Licenses or applications in 30+ markets, including Mexico, India, Japan, and Australia

But global success does not automatically translate to South African relevance.

This is where Dr. Magomola’s appointment becomes transformational.

His background in regulatory leadership, public-sector financing, banking turnarounds, risk governance, and financial inclusion bridges the gap between a European fintech superpower and the realities of South African households, SMEs, and regulators.

Revolut’s SA Opportunity at a Glance

| Metric | Value |

|---|---|

| Global customers | 65M+ |

| SA adult population | ~50M |

| Unbanked adults | ~4M (9%) |

| Mobile penetration | 95%+ |

| Target launch services | Loans, savings, crypto, FX, remittances |

A Defining Moment for African Fintech

Revolut hiring Dr. Gaby Magomola shows Revolut understands that expansion into South Africa cannot be copy-pasted from Europe. It requires deep respect for local regulation, cultural diversity, and the realities of inequality.

With Dr. Magomola guiding its South African mission, Revolut gains not just an advisor but an anchor: someone capable of translating global fintech ambition into inclusive, sustainable financial innovation.

As interest grows around Revolut’s licence application, one thing is clear:This partnership could reshape the competitive landscape of South African banking.

Will Revolut become the next major disruptor? Time and SARB’s decision will tell.

Revolut: Banking, Business & User Insights

Revolut Bank continues to expand globally with digital-first accounts, while Revolut Business offers multi-currency accounts, invoicing, and international payments for SMEs and startups. User feedback from Revolut reviews highlights fast transfers, low FX fees, and an intuitive app.

When comparing Revolut vs Wise, Revolut is favoured for broader features like budgeting, crypto, and stock trading, while Wise leads on transparent FX rates.

New customers can easily begin through Revolut Sign up, which requires ID verification in-app. For investors tracking fintech markets, Revolut stock remains privately held, with no publicly traded shares yet.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, climate change, and digital finance at Africa Digest News.

Leave a Reply