TymeBank has officially transitioned to GoTyme Bank in South Africa, with the rebranding taking effect in January 2026.

This change unifies the South African operation’s identity with the broader Tyme Group, reflecting the institution’s evolution into a global digital banking platform while preserving its strong local roots and regulatory status.

The institution remains a fully licensed and regulated South African bank, with no alterations to customer accounts, balances, or oversight by the relevant authorities.

Backed by Patrice Motsepe’s African Rainbow Capital and maintaining key retail partnerships with Pick n Pay and Boxer, GoTyme Bank continues to serve more than 10 million customers through its hybrid model of physical kiosks and digital channels.

GoTyme Bank reflects who we are today and where we are going next as part of a global banking group with a strong South African foundation. This is not a change to our fundamentals; it is now expressed through a brand and platform that better reflects our scale, technology, and ambition

Cheslyn Jacobs, CEO of GoTyme Bank South Africa

Drivers of the Rebranding

The rebranding aligns South African operations with the Tyme Group’s high-growth activities in Asia, including an established presence in markets such as the Philippines and Vietnam.

The unified GoTyme identity facilitates shared technological advancements, operational synergies, and a consistent global brand experience, while reinforcing the institution’s commitment to accessible, low-cost banking in South Africa.

The transition follows TymeBank’s achievement as the first digital bank on the continent to reach profitability and its growth to over 20 million customers across multiple markets.

The name change signifies maturity, scale, and forward momentum rather than a fundamental shift in business model or ownership.

Key Changes and Customer Impact

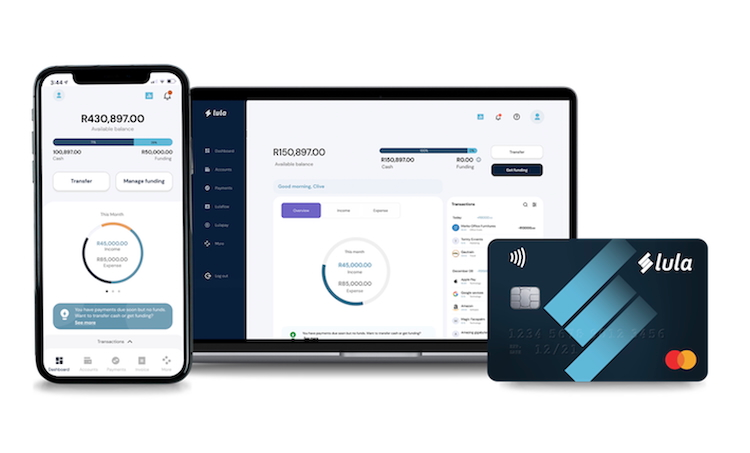

A central element of the rebranding is the launch of the new GoTyme Bank mobile application on 22 January 2026.

The app rollout occurs in phases to prioritise security and stability, with existing customers downloading the updated version and logging in using their current credentials.

All transaction histories, account details, and services transfer seamlessly, ensuring uninterrupted access.

The refreshed app introduces a cleaner, more modern design, enhanced performance, strengthened security features, and an intuitive interface for managing finances, including saving, spending, and sending money.

While the brand evolves, core operations including branchless digital banking, retail kiosk partnerships, and the low-cost model remain intact.

Customers experience continuity in service delivery alongside an elevated brand that better communicates the institution’s global ambition and technological capabilities.

Strategic and Market Implications

The rebranding supports Tyme Group’s vision of delivering a transformative retail banking experience that originates in Africa and extends globally.

READ ALSO:Who Is Cheslyn Jacobs and Can He Take TymeBank to the Next Level as CEO?

By adopting the GoTyme name, the South African entity gains clearer alignment with international counterparts, enabling accelerated innovation, cross-border capabilities, and enhanced customer empowerment through simple, transparent, and affordable services.

This move reflects broader trends in African fintech toward global integration and brand consistency as institutions scale beyond domestic markets.

Looking Ahead

TymeBank’s rebranding to GoTyme Bank in January 2026 represents a deliberate evolution that unifies its identity with the Tyme Group’s international presence while reaffirming its South African foundation.

The change, accompanied by a new app launch, enhances digital capabilities without disrupting customer services or regulatory status.

As of February 5, 2026, this transition positions GoTyme Bank to pursue greater scale, technological advancement, and impact in accessible banking. For detailed guidance on the app update or services, refer to official GoTyme Bank resources.

TymeBank Overview

The TymeBank app is the mobile platform customers use for digital banking, and you can do a TymeBank app download from the Apple App Store or Google Play.

After opening an account through TymeBank open account, users access their funds using TymeBank login with their TymeBank login PIN.

TymeBank provides support through a TymeBank contact number and often a TymeBank WhatsApp number for customer enquiries.

Once set up, your TymeBank account lets you check balances, send money, pay bills and manage finances entirely via the app.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, climate change, and digital finance at Africa Digest News.

Leave a Reply