Access to capital remains one of the biggest challenges facing entrepreneurs and small businesses in Kenya. Whether you’re launching a startup, scaling an SME, or navigating cash flow issues, securing the right funding can make or break your business.

With a growing number of financial institutions and government-backed programmes offering business loans in Kenya, understanding your options is critical before taking the leap.

This guide breaks down the essentials you need to know, from SME loans in Kenya to government initiatives like the Hustler Fund Kenya, to help you choose the most suitable loan for your needs.

1. The Landscape of Business Loans in Kenya

Kenya has a vibrant and diverse credit market tailored for small and medium-sized enterprises (SMEs), with various institutions offering customised financial solutions. These include commercial banks, microfinance institutions, and digital platforms.

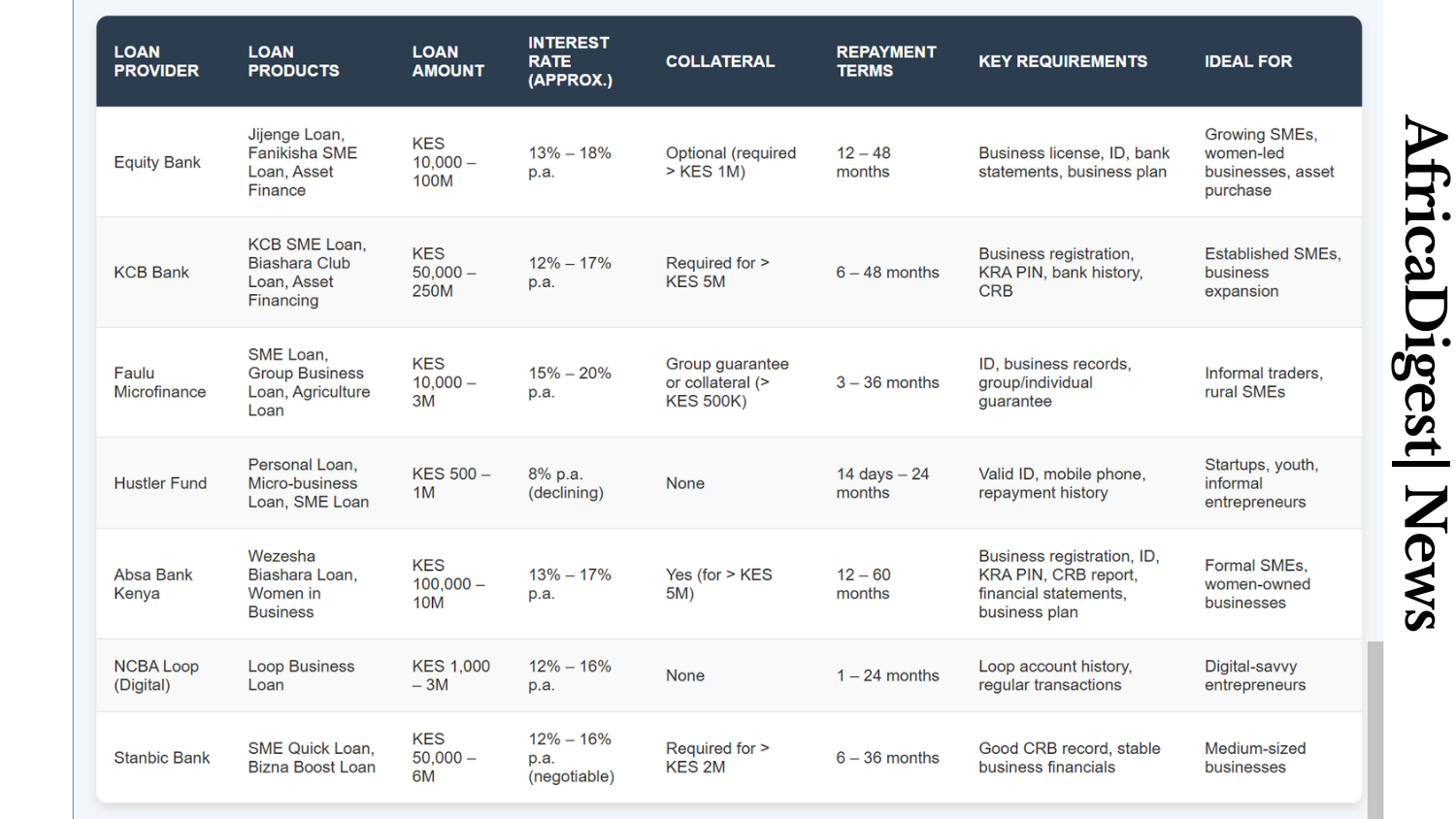

Top providers include:

- Equity Bank business loans, including the popular Jijenge Loan.

- KCB business loans targeting startups, SMEs, and corporates.

- Faulu business loans Kenya is known for flexible repayment plans.

- Hustler Fund Kenya (government-backed financing for micro and small enterprises)

These institutions cater to a wide range of needs, from unsecured business loans in Kenya to low interest business loans Kenya for startups and women-led businesses.

2. Types of Business Loans Available

Before applying, it’s crucial to understand the different types of business loans for entrepreneurs in Kenya:

a. Term Loans

These are fixed-amount loans repaid over a specific period. Offered by major banks like KCB and Equity, term loans are suitable for long-term investments such as equipment purchases, office space, or vehicle acquisitions.

b. Working Capital Loans

Designed to help businesses meet daily expenses such as payroll, inventory, or utilities. These loans often come with flexible terms and quick disbursement.

c. Asset Financing

Perfect for SMEs looking to acquire movable assets such as machinery, delivery vans, or computers. This option is popular among manufacturing and logistics businesses.

d. Unsecured Business Loans

Several institutions now offer business loans without collateral in Kenya, making them accessible to startups or small businesses that lack assets. However, expect higher interest rates due to the risk factor.

e. Specialised Loans

Programs like SME loans for women in Kenya and business loans for startups in Kenya are designed to boost inclusion and innovation. Banks such as Faulu and Equity have targeted products for these segments.

3. Notable Loan Products in Kenya

Let’s explore some of the standout Kenya SME financing options:

Equity Bank Jijenge Loan Kenya

The Jijenge Loan allows customers to save while accessing affordable credit. It’s ideal for small business owners who are also looking to build a credit history.

KCB SME Loans

KCB offers both secured and unsecured loans, overdraft facilities, and asset finance. The requirements for KCB SME loans typically include a valid business licence, six months of bank statements, and a business plan for start-ups.

Hustler Fund Loan Application Kenya

Launched by the Kenyan government, the Hustler Fund provides accessible loans to individuals and small businesses. The Hustler Fund Kenya doesn’t require collateral and is available via mobile applications. Loan limits grow with successful repayments, making it a good entry point for new entrepreneurs.

Faulu Business Loans Kenya

Faulu offers a wide range of credit products, including group business loans, individual SME loans, and agriculture-focused packages. Known for flexibility, it is a reliable partner for rural and urban small businesses alike.

READ ALSO:

What Is Fuliza and How Is It Different From M-Shwari Loans?

4. How to Apply for Business Loans in Kenya

The how to apply for business loans Kenya process varies across institutions but generally involves:

- Business Registration: Your business must be legally registered with supporting documents (certificate, PIN, licence).

- Bank Statements: Most lenders require at least 6 months of bank activity.

- Business Plan: Especially for startups, a solid plan can determine loan approval.

- Credit History: Institutions will check your personal and business credit scores.

- Collateral (if required): For secured loans, title deeds, logbooks, or asset ownership documents may be needed.

Digital lenders and the Hustler Fund have simplified application processes, often requiring just your ID and mobile money transaction history.

5. Choosing the Best Business Loan for Your Needs

The best business loans for SMEs Kenya 2025 depend on your:

- Business size and sector

- Purpose of the loan (working capital vs. expansion)

- Ability to provide collateral

- Preferred repayment schedule

Consider comparing loan interest rates, processing times, customer support, and any hidden charges. For example, while low-interest business loans Kenya are ideal, high processing fees can negate those savings.

6. Common Mistakes to Avoid

- Underestimating the Total Cost of Borrowing: Always factor in interest, penalties, and processing fees.

- Taking Unnecessary Loans: Only borrow what you can repay comfortably.

- Failing to Read the Fine Print: Understand terms like default penalties, interest recalculation methods, and early repayment clauses.

- Ignoring Credit Scores: Maintaining a good CRB rating improves your chances of approval.

Final Thoughts

Navigating the landscape of business loans Kenya doesn’t have to be overwhelming. With numerous options available, from KCB business loans and Equity Bank Jijenge Loan Kenya to Hustler Fund loan application Kenya, entrepreneurs can find financing that aligns with their business goals.

Whether you’re seeking SME loans in Kenya for expansion or exploring business loans for women in Kenya, knowledge is your best asset.

Take time to research and understand the Kenya business loan requirements and match your business needs to the right financial partner.

Leave a Reply to Africa Digest News Cancel reply