In 2025, investing is no longer limited to high-net-worth individuals or financial gurus. Thanks to a wave of mobile-first platforms, investment apps for Kenyans now offer seamless access to stocks, Treasury bills, unit trusts, and other opportunities, all from your smartphone.

Whether you’re a first-time investor, a Gen Z professional building wealth early, or a member of the diaspora looking to grow assets back home, the right app can make all the difference.

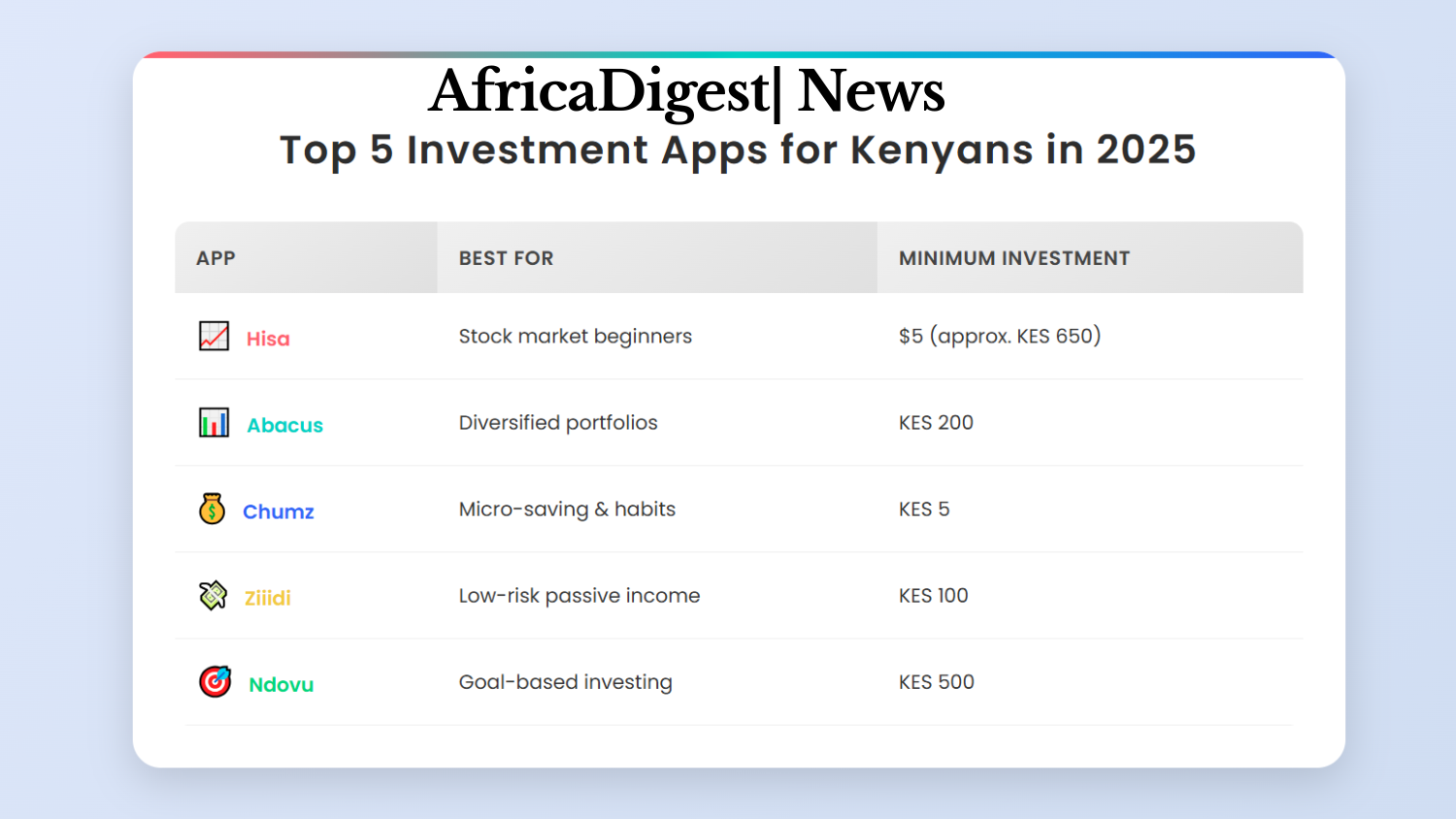

Here’s a detailed look at the top 5 investment apps in Kenya 2025, covering their features, target users, and how they stack up.

1. Hisa App Kenya: Best for Stock Market Beginners

Hisa provides access to over 6,000 global and local assets, including Kenyan stocks, U.S. equities, ETFs, REITs, and mutual funds.

The app supports fractional investing, allowing users to start with minimal capital. It also offers educational resources like podcasts and market news to help users make informed decisions.

Key Features:

- Access to Kenyan and U.S. stock markets

- Fractional investing options

- Real-time market data and news

- Educational content and community engagement

Minimum Investment: $5 (approx. KES 650).

READ ALSO:

SACCOs vs Money Market Funds in Kenya: Where Should You Invest in 2025?

2. Abacus Investment App Kenya: Best for Diversified Portfolios

Abacus offers a comprehensive suite of investment options, including stocks, government securities, and unit trusts. The platform is linked with multiple fund managers and brokers, providing users with a broad range of investment choices.

Key Features:

- Invest in shares, government securities, and unit trusts.

- Built-in risk assessment tools

- Integration with multiple fund managers and brokers

- Available on web and mobile platforms

Minimum Investment: KES 200.

3. Chumz: Best for Micro-Investing and Savings Discipline

Chumz is designed to help users cultivate saving habits through behavioural incentives and gamification. Users can set personal or group saving goals and automate savings with customisable rules. The app invests savings in low-risk instruments like money market funds.

Key Features:

- Start saving with as little as KES 5.

- Personalised saving goals and challenges

- Invests in low-risk instruments

- Available on Android and iOSchumz.iochumz.io

Minimum Investment: KES 5. Note: Withdrawal fees may apply (e.g., KES 20).

4. Ziiidi:Best for Low-Risk Passive Income

Ziiidi offers a straightforward platform for Kenyans to invest in money market funds with competitive returns. With investments starting at just KES 100, it’s accessible to a wide audience, particularly those looking for low-risk options to grow their money passively.

Key Features:

- Invest in money market funds with competitive interest rates.

- Simple onboarding via Android/iOS app.

- No bank account required; integrates with mobile money.

- Regulated by the Capital Markets Authority (CMA).

Minimum Investment: KES 100.

READ ALSO:

What Are Treasury Bills and Bonds? A Beginner’s Guide for Kenyans in 2025

5. Ndovu: Best for Goal-Based Investing and Robo-Advisory

Ndovu offers professionally managed portfolios tailored to users’ financial goals. The platform provides access to U.S. stocks, ETFs, government bonds, and money market funds. Users can start investing with as little as KES 500.

Key Features:

- Goal-setting tools for various financial milestones

- Invest in global ETFs and local unit trusts.

- Automatic portfolio rebalancing

- Expert-curated investment plans

Minimum Investment: KES 500

How to Choose the Right App for You

The rise of investment apps in Kenya has democratised access to financial markets. Whether you’re interested in stocks, treasury bills, or building a nest egg through goal-based saving, there’s a platform tailored to your needs. Start small, stay consistent, and leverage these tools to build your financial future.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, and digital finance at Africa Digest News.

Leave a Reply to Georgina Nderitu Cancel reply