Kenya’s digital payments boom of 1.2 billion transactions in Q1 2025, with e-commerce up 25% YoY to $1.5 billion, has long masked a structural fault line: formal merchants accept cards easily, while the informal economy, which drives 70% of GDP, remains largely cash-bound.

Card terminals cost money, onboarding takes weeks, and traders routinely lose 20–30% of potential sales simply because they cannot accept cashless payments.

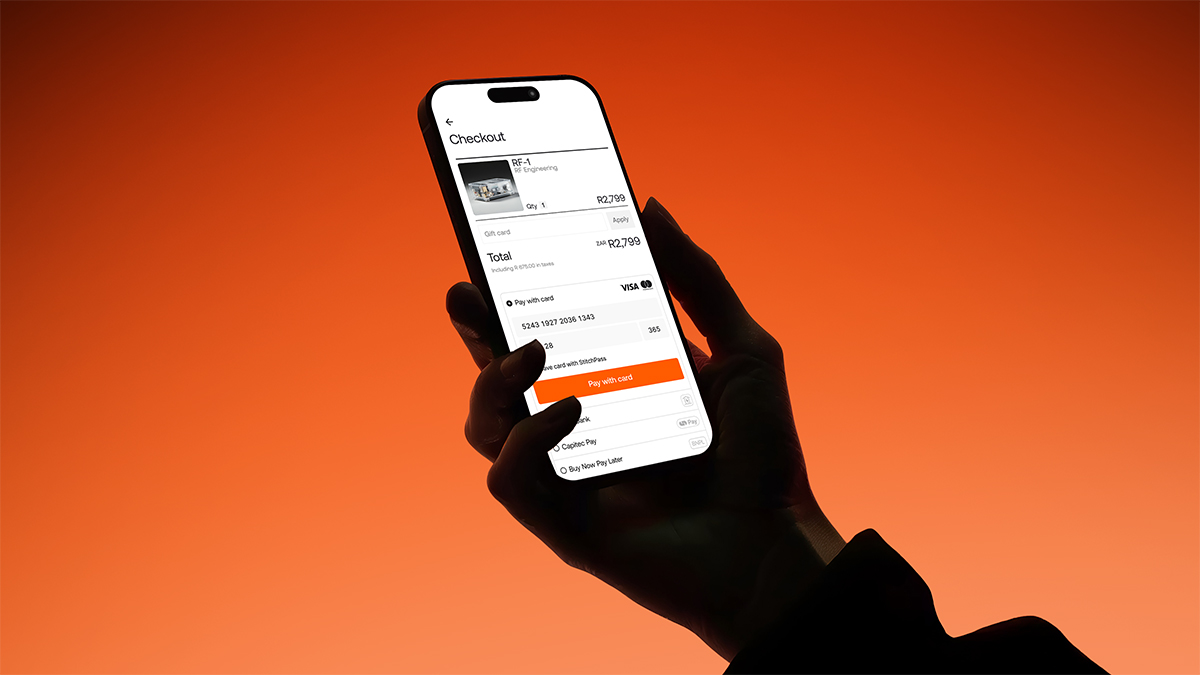

That gap narrowed dramatically on 4 December 2025, when KCB Bank Kenya and Visa launched Tap-to-Phone, a feature that turns any NFC-enabled Android smartphone into a contactless card-acceptance device.

No terminal. No rental. No hardware investment. A merchant downloads the KCB app, activates Tap-to-Phone, and begins accepting Visa card and wallet taps instantly. Funds settle to their account in seconds.

KCB’s Director of Retail Banking Jane Isiaho-Otieno framed the rollout as overdue relief for small traders: “We’re simplifying access to payment acceptance, cutting costs for small businesses that have long struggled with expensive equipment.”

With card acceptance stuck below 40% despite 85% adult mobile-money penetration, KCB and Visa are betting that eliminating hardware barriers could unlock KSh 100 billion+ in previously lost sales by 2027.

As Kenya’s second-largest bank by assets (KSh 1.8 trillion), KCB is pushing hard into digital: 80% of its transactions now run through mobile and online channels.

Tap-to-Phone builds on its earlier Tap-to-Pay customer rollout but flips the model, empowering merchants rather than consumers.

Visa, meanwhile, brings the compliance backbone. With 4.4 billion cards globally and more than 10 million in Kenya, Visa runs the tokenisation and security layer that enables PIN-verified contactless transactions directly on a phone.

Global pilots show fraud incidence below 0.1%, giving Tap-to-Phone a security profile comparable to traditional POS terminals.

Together, the pair have the reach and infrastructure to pull informal traders into the digital economy at scale, aligning with the Central Bank of Kenya’s 90% digital payments target by 2027.

How Tap-to-Phone Works: Terminal in Your Pocket

Tap-to-Phone’s value lies in its simplicity. A merchant already holding an NFC-enabled Android device, which the majority of urban traders do, can be operational in minutes.

Registration, bank linking and activation all happen within the KCB Mobile or KCB M-PESA app. From there, a customer simply taps their Visa card or mobile wallet on the back of the merchant’s phone; PIN verification triggers instant settlement.

The absence of hardware fees is critical. Traditional POS devices cost KSh 20,000+ upfront plus monthly rentals, shutting out nearly all micro-businesses.

Tap-to-Phone eliminates that entire cost structure, with merchant service fees of 1–1.5%, lower than typical POS rates.

READ ALSO:What FNB and Airtel’s Wallet-on-POS Partnership Means for Zambians

| Barrier | Traditional POS | Tap-to-Phone | Savings |

|---|---|---|---|

| Upfront Cost | KSh 20,000+ device | Zero (use phone) | KSh 20,000 |

| Monthly Rental | KSh 2,000–5,000 | None | KSh 24,000+ per year |

| Setup Time | 1–2 weeks | Minutes | Instant operations |

| Compatibility | Cards only | Contactless cards + wallets | 90% coverage |

The economics are self-explanatory. Removing hardware and rentals slashes annual acceptance costs by tens of thousands of shillings of capital that SMEs can redirect toward inventory, staffing or expansion.

KCB predicts 100,000 merchants onboarded in the first year, starting with street vendors, service providers and delivery riders.

For the tens of thousands of Kenyan traders who operate outside formal retail infrastructure, including mama mbogas, jua kali artisans, boda boda riders and mobile service providers, the inability to accept cards often means turning away paying customers. Tap-to-Phone flips that equation.

A roadside vendor can accept a KSh 500 tool payment via tap. A salon can receive wallet-based payments without waiting for an agent POS. Delivery riders can settle variable fares instantly rather than juggling change or leaving customers to scramble for cash.

This is not merely convenience, as it also expands market reach. With more consumers carrying cards and wallets than cash, acceptance becomes a growth lever, not an optional extra.

Kenya’s 1.2 billion Q1 payments reflect a digital culture powered overwhelmingly by mobile money; M-Pesa controls 96.5% of mobile wallet volumes.

But card acceptance has lagged, particularly in the informal economy. Tap-to-Phone bridges that gap, enabling Visa to penetrate merchant categories historically dominated by cash and M-Pesa.

The stakes extend beyond convenience. Digital acceptance for women-led informal businesses estimated at 60% of the sector reduces theft risk, increases transaction traceability and mobilises credit data that banks can use for SME lending.

The rollout also syncs with AfCFTA’s push for seamless regional trade, where interoperable card infrastructure becomes an enabler.

The result is a more inclusive payments ecosystem, a stronger cash-lite trajectory, and a pathway to KSh 100 billion+ in new digital sales.

For merchants, the formula is simple: download the app, tap, get paid. For Kenya, it’s another leap forward in fintech leadership.

KCB Overview

KCB’s digital tools continue to expand convenience for customers, from the KCB tap to phone number service to simple guides like How to load KCB Prepaid Card via Mpesa and the downloadable KCB temporary Card pdf.

Users can manage accounts through the KCB Mobile app, easily learn How to check balance on KCB Prepaid Card, and access the KCB Prepaid Card portal for transactions.

KCB also offers flexible payment options with the KCB me cash Card and the widely accepted KCB Mastercard Debit Card, supporting seamless banking and payments across Kenya.

Ronnie Paul is a seasoned writer and analyst with a prolific portfolio of over 1,000 published articles, specialising in fintech, cryptocurrency, climate change, and digital finance at Africa Digest News.

Leave a Reply